Silver in the forex

Silver in the forex is one of the precious metals which gets more and more attention because of the global green energy transition. This white metal price in the forex market is subject to global financial stability and broader economic trends due to market speculation and investor sentiment. It is usually considered gold’s younger brother (XAUUSD) with the same reputation for reliability and has been used as an exchange in many societies; here we should mention that it is quite volatile compared to the gold but it has strong direct correlation with gold price. It plays a crucial role when there is world economic data release and/or interest rate changes. Silver tends to fluctuate more in accordance with shifts in or expectations for economic indices like GDP growth and industrial production that are particularly related to commodities. The fact that silver has a strong link with gold but also, often, with copper and the larger commodities complex serves as an example of the metal's dual nature.

Silver History

Silver was mined for the first time about 3000 BCE in today's Türkiye location which was named Anatolia at that time. Then Its mining spread to Spain, where was essential to the Roman Empire's foundation and the Silk Road's prosperity. It has a unique prefect shine; and became more popular between 11-16 centuries as humans found more mines and improved their production techniques. During those times the quest for Spanish fleets which was said all over the world increase dramatically and it was seeking wealth and new lands to conquer. Silver was a key component of the global mercantile system. On 1870s the silver production increased in Neveda, United States, because of the Comstock Lode. By the end of the 19th century, people were producing over 120 million troy ounces of silver annually, which is evidence that silver was used as currency in the most iconic manner. But in early 1960 US government decided to stop using silver in the coins because of supplies declined to its all-time low. For instance, at that time (and before) all American coins contain almost 90% silver. To clarify this topic, it is good to provide an example; Assume that American coins are worth approximately 14 times their face value due to the precious metal content alone, and that silver costs $20 per ounce. A silver dime (One-dollar American coin) is worth $1.40, while each silver dollar is app. value $14 at a $20 per ounce price.

What is Silver in the forex?

Silver in forex is one of the precious metals which gets more and more attention because of the global green energy transition. This white metal price (silver international price) in the forex market is subject to global financial stability and broader economic trends due to market speculation and investor sentiment. It is usually considered gold’s younger brother with the same reputation for reliability and has been used as an exchange in many societies; here we should mention that it is quite volatile compared to the gold but it has strong direct correlation with gold price. It plays a crucial role when there is world economic data release and/or interest rate changes. Silver tends to fluctuate more in accordance with shifts in or expectations for economic indices like GDP growth and industrial production that are particularly related to commodities. The fact that silver has a strong link with gold but also, often, with copper and the larger commodities complex serves as an example of the metal's dual nature.

Silver trading symbol

Silver forex symbol meaning comes from the Latin word argentum, which means "silver" and is related to the Greek meaning "bright" or "shiny”. This forex symbol retains his Latin origin due to historical usage in alchemy and early chemistry which is represented by AG. This practice is common in the periodic table, particularly for elements that have been known since ancient times. The "X" came from "Index," so we get XAG, and most commonly we have a cross pair of silver and the US dollar, so it creates "XAGUSD” which is the silver symbol meaning in forex.

Production and reserves

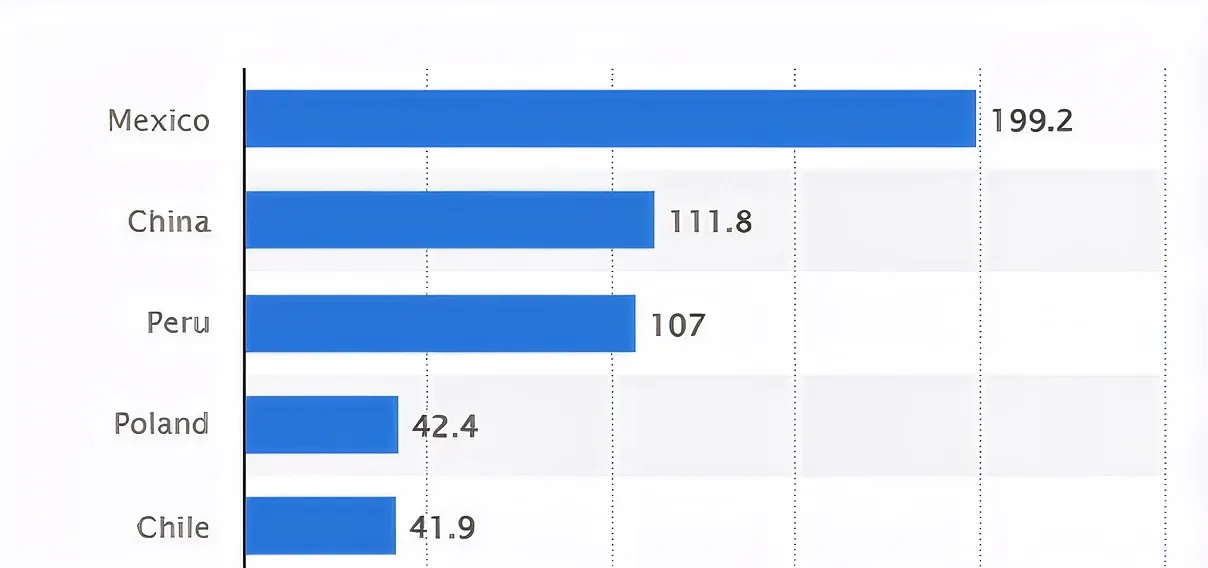

According the recent report in Statista the largest website producers of Silver by Country are (2022):

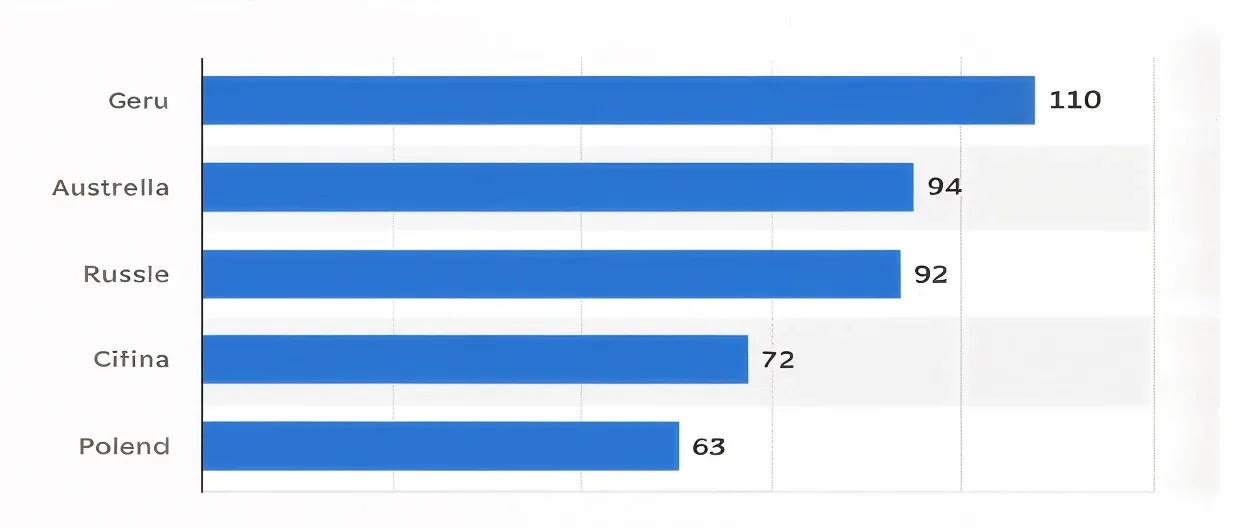

On the other side, the countries that hold the most silver in the world are not the same as the producer. The below data estimates are derived from data provided by mining and geological surveys globally, highlighting the leading nations with substantial silver:

Silver correlation in Forex

The white metal is an essential element in many industries such as solar panels, conductors and semi-conductors, touch screens, medical devices, chemical catalysts, etc. As we can’t live in today’s world without computers and cell-phones and in general electronic devices, silver is one of key factors because of its high electrical conductivity and durability. Any electric device which has an on/off button, it is likely to contain silver inside.

The silver international price is affected by macroeconomic, geopolitical, technical factors and some other like industrial demands and silver scraps. Generally, everybody acknowledges that the past performance does not indicate the future act and the silver is not out of this judgment. But by looking at its silver international price history in the market, we can pearl the valuable information. If it is really high, it presents an uptrend which means price can potentially continue higher.