What is XAUUSD

What is XAUUSD, and why do all traders consider it as the Gold symbol? This is one of the intellectual concerns of new traders who just start activity in the forex market. Some traders and/or individuals who are at the beginning of a trading journey may mistakenly view XAUUSD as equivalent to real gold, but in reality, these are distinct assets with some differences. While they are related, they are not the same. To understand the distinction between XAUUSD and physical gold, it's helpful to explore the history of gold and its role in the financial landscape that evolved into various forms including gold futures, gold exchange-traded fund (ETFs) and why forex traders use the term XAUUSD. It represents a financial instrument rather than a tangible commodity but provides a means for traders to engage with the gold in the forex market.

Gold History

This beautiful metal was the world's first luxury object, and it was perfect for everyone to utilize in their own way, whether as jewelry or as a currency to purchase something. They were used to fill temple vaults in ancient Greece, and as humans remember, they were a common commodity in the economy long before the modern idea of money was developed. After 1944 the Bretton Woods agreement established a new global financial system for commercial relations among the United States, Canada, Western European countries, and Australia and other countries (in total of 44 nations); the US dollar was central to this agreement, and the dollar itself was backed by gold. It also carried the creation of the World Bank and the International Monetary Fund.

From the earliest civilizations to modern-day economies, gold's journey from raw streams to vaults of global finance reveals its enduring significance as a symbol of wealth and stability; it used to play a key role in determining a country’s wealth and controlled the amount of money a nation could print, and influenced the value of its currency.

Production and reserves

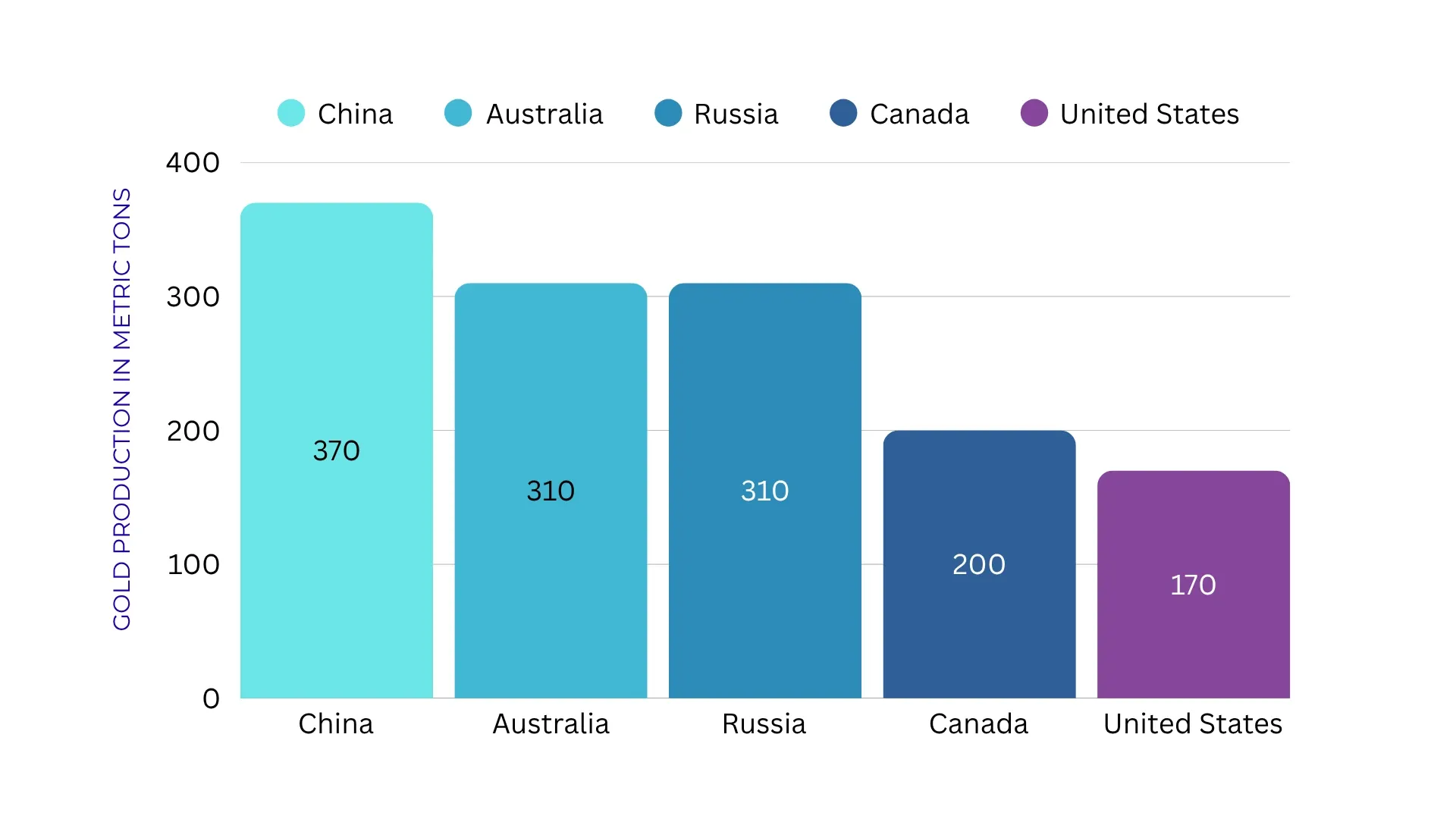

Most countries tried to increase their production of this valuable item year by year. According to a recent report, the largest producers of Gold by Country are (Updated 2024):

In the first half of 2024, a new high of 483 tons of gold were bought by central banks, while the 45 tons purchased in the first half of this year, Turkey was the biggest buyer of gold. In the first six months, India bought 37 tons of gold, placing it in second place. China, which has historically been a major buyer, has recently reduced its gold imports. The Chinese central bank had been raising its gold holdings for the previous eighteen months.

On the other hand, the countries that hold the most gold in the world are not the same as the producers. Due to their safety, liquidity, and return characteristics, central banks hold the majority of the world’s gold reserves.

Why Named XAUUSD?

What is XAUUSD in the world of forex? Popular trading pairs in this market enable traders to speculate on price movements without physically holding the currency; each of these pairs has its own symbol in the forex market that concisely combines two abbreviations of each traded side or currency. For instance, when you trade EURUSD, you are trading the price of one Euro relative to one US dollar, which is obvious to everyone. However, you might wonder why the XAU abbreviation displays the gold symbol. In the chemical periodic table, gold is represented by AU with atomic number 79, which is taken from the Latin word 'Aurum', and the "X" is derived from "Index," so we get XAU, and most commonly we have a cross pair of gold and the US dollar, so it creates "XAUUSD." Therefore, when XAUUSD equals 2000, it indicates that an ounce of gold is priced at 2000 USD. Anyone wanting to purchase gold can own an ounce for 2000 US dollars. Today, XAU is seen as a reliable hedge against inflation. Many believe that investing in gold can safeguard their wealth during economic downturns, as it tends to maintain its value over time. Usually, no other currency traded against XAU. It’s because comparing the value against other currencies is quite difficult. The US dollar is the sole standard for valuing XAUUSD, simplifying calculations and avoiding complications with other currencies. This is practical because the US dollar serves as the world's primary reserve currency, making it a widely accepted benchmark for measuring value globally. This standardization is crucial for maintaining clarity and efficiency in global finance, enabling the XAUUSD pairing to convey price information clearly across international banking, business, and trading platforms. It aligns with the broad acceptance and recognition of ISO 4217 codes, ensuring a consistent understanding worldwide.

Physical Gold vs XAUUSD

There are some minor differences between the XAUUSD vs Gold, which table below clarify more for our understanding:

| Physical Gold | XAUUSD |

| When a user purchases the physical gold, they purchase the asset itself and have it in their hands. | When users trade XAUUSD on forex trading platforms, they are trading on the gold’s relative value to the US dollar. |

| It is real gold that can be seen and touched, or we can say it is a tangible asset. It can be found in jewelry, coins, and gold bars. | It refers to the exchange rate of gold traded in the foreign exchange market against the US dollar |

| The transactions (buying and selling) usually happen from dealers | The transactions (buying and selling) happen on platforms. |

| It requires a physical location for storage | It doesn't require physical storage and can be held directly on a Forex platform |

| It is relatively liquid but selling physical gold requires finding a buyer and can involve additional costs like transportation, insurance, and storage | It is highly liquid and can be traded 24/5, which allows for quick transactions |

Mishov Markets tries to simplify understanding how XAUUSD is measured and traded in the forex market, the lot size for XAUUSD is the amount of its, which client will be buying or selling and is usually expressed in troy ounces. One standard lot (1.0) on the trading platform represents 100 ounces of XAUUSD. For instance, if the client is willing to risk $100 and accept $100 as an adverse price movement in the price of XAUUSD, the client can trade one ounce (0.01 lots).

What is XAUUSD’ it's important to note that, while it's widely regarded as a safe-haven asset during financial crises, its price is still influenced by the overall health of the global economy. Economic stability, interest rates, inflation, and geopolitical factors all play a significant role in determining its value, reflecting both investor sentiment and broader market conditions and traders should keep an eye on all these while trading XAUUSD.