Purchasing Managers Index (PMI)

The purchasing managers’ index, frequently known as PMI, is a monthly study that offers information about the state of the manufacturing industry. The Institute for Supply Management (ISM) publishes it, and it is a leading predictor of overall economic activity. This monthly survey of supply chain managers across different industries, covering both upstream and downstream activity and is surveyed about key metrics like production levels, new orders, employment, supplier delivery times, and inventories. The headline PMI number is calculated by asking respondents five questions about the above-mentioned areas; a reading exceeding 50 signifies expansion, whereas a reading below 50 signifies contraction and a score of 50 indicates no change. Leaders of the National Association of Purchasing Management, which is now known as the Institute for Supply Management (ISM), identified survey data in the 1940s as potentially offering important early indicators of business cycle shifts. To close this knowledge gap and assist purchasing executives in making more informed choices, they developed the first purchasing managers' index as a proprietary indicator.

What is the PMI in forex?

As mentioned above the PMI (purchasing managers index) is one of the most important influential fundamental indicators which frequently has a significant effect on the Forex market. When a country’s PMI improves, its currency usually gains value. For instance, the GBP currency faces upward pressure if the British PMI improves. On the other hand, the PMI falls when the GBP currency weakens. However, other currencies like the Japanese yen are related to board market sentiment rather than domestic statistics. Additionally safe-haven currencies such as Swiss franc and/or Japanese yen react negatively to increases in PMIs of the world’s major currencies and positively to their decline. There are three types of PMIs but traders are generally unfamiliar with the third type. These are for three different sectors: manufacturing (the manufacturing PMI), services (the services PMI and/or the non-manufacturing PMI), and construction (the construction PMI).

How to Calculate the PMI?

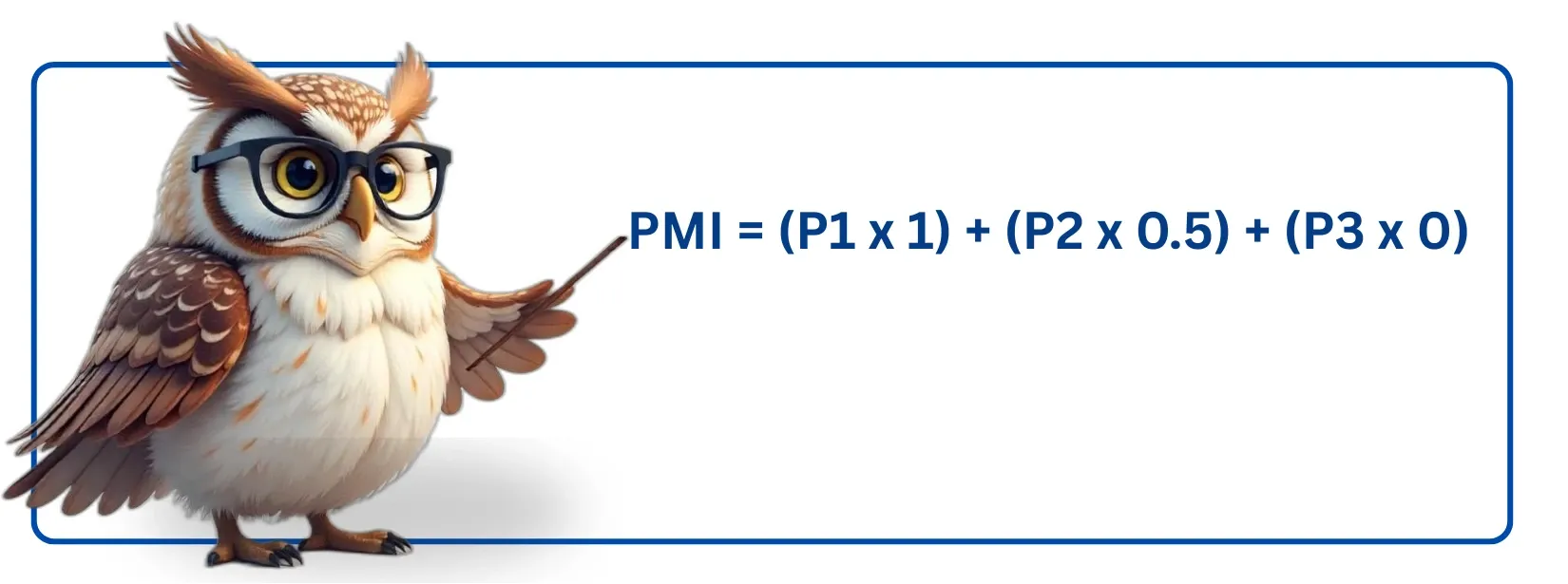

The PMI calculator formula assigns weights to monthly survey responses regarding business conditions. The formula sums the weighted figures for five key components, including new orders, production, employment, supplier delivery times, and inventories. The purchasing manager index is calculated by multiplying the percentage of survey responses reporting improved conditions by 1, the percentage reporting no change by 0.5, and the percentage reporting worsening conditions by zero.

The "improving percentage," denoted by P1, is the proportion of survey participants who indicate an increase in a variable, such as production or new orders, during the preceding month.

The "no change" percentage, or P2, is a measure of the proportion of respondents who say that a variable has not changed from the previous month.

The "deteriorating percentage," or P3, is a measure of the proportion of respondents who say that a variable has decreased from the previous month.

So as mentioned in the previous part, if the PMI calculator shows 50, it means that the sector experiences no change. A reading above 50 shows the sector improved while a reading below 50 means a deterioration.

The impact of the PMI index on Forex

It offers information about the state of the manufacturing and not manufacturing industries' economies. Thus, it influences central bank policy, investor mood, and the strength or weakness of the economy, all of which have an impact on a nation's currency. Central banks assess this information to determine whether to adjust interest rates in an effort to stimulate economic growth or control inflation. A strong economy often correlates with a stronger currency as it attracts foreign investment and supports favorable trade balances. On the other hand, economic struggles can lead to currency depreciation, impacting international trade dynamics and investor returns. By analyzing the numbers and trends reported, they can make informed predictions about potential currency movements. This analysis helps them to adjust their foreign exchange strategies accordingly, allowing them to navigate the complexities of the global market more effectively.

Why is PMI important?

As previously stated, data from a number of sub-components, including new orders, production, employment, supplier deliveries, and inventories, are gathered by the purchasing managers index (PMI).

An all encompassing perspective can be instrumental in identifying potential bottlenecks that may hinder progress within various industries. It can also highlight important advantages that some industries have, which helps us comprehend the complex dynamics of economic activity on a more thorough level. Examining every face of this activity helps one understand how various components interact, which helps one see the potential and obstacles more clearly.

Understanding these diverse facets not only provides a better grasp of the current economic landscape but also aids policymakers and stakeholders in making informed decisions that could enhance overall economic performance. Such an approach fosters a deeper awareness of the interconnectedness of various sectors, illuminating pathways for improvement and growth.

Data from different countries and historical periods may be easily compared because of the index's architecture. Because it is conducted on the previously indicated scale, it is easy to interpret. PMI news forex data is also available for a number of countries throughout the world.

How does PMI affect a country’s currency?

The importance of comparative monthly tallies cannot be overstated, as they provide decision-makers with valuable insights into evolving trends much earlier than when gross output figures are available. These early indicators are crucial because they can reveal heights that suggest faster growth in specific areas of the economy. When strategists observe these positive trends, they gain the opportunity to implement preventive measures that can help maintain or even accelerate this growth. Conversely, when there are declines in the tallies, they signal a potential decrease in market traction, which may lead to a reassessment of current strategies. Such declines are essential for identifying areas that may require reform or adjustment, allowing businesses to address challenges proactively.