Producer Price Index (PPI)

The Producer Price Index (PPI) is known as the average change over time in the selling prices that regional producers receive for their goods. The PPI bases its pricing on the initial business transaction for a large number of goods and services. The U.S. Bureau of Labor Statistics (BLS) collects the Producer Price Index (PPI), which was known as the wholesale price index from 1902 to 1978. Each month, the BLS examines over 64,000 price quotes from over 16,000 businesses, representing thousands of different goods and services. It is a measure of wholesale inflation that is derived from hundreds of producer pricing indices arranged according to industry and product category. While the CPI (Consumer Price Index) gauges consumer prices, the PPI (Producer Price Index) tracks wholesale inflation. To calculate the overall monthly change in final demand, the Producer Price Index (PPI) takes into account industries, goods and services, and the buyer's economic identity but Consumer Price Index (CPI) measures price change from the purchaser's perspective. Sellers' and buyers' prices can vary because of factors such as government subsidies, sales and excise taxes, and distribution expenses.

What is the PPI index?

There are three major PPI classification schemes that use the collection of pricing details submitted to the BLS by collaborating corporate reporters:

Industry classification: It is a gauge of shifts in prices paid for the industry's net output, or its products sold outside the industry. Index codes from the North American Industry Classification System (NAICS) offer comparability with a variety of industry-based data for other economic programs, such as wages, earnings, employment, productivity, and production.

Commodity classification: Regardless of the industry classification of the producing establishment, the PPI's commodity classification structure arranges goods and services according to material composition or similarity.

Commodity-based Final Demand-Intermediate Demand (FD-ID) System. With the January 2014 data release, the FD-ID system took over as the primary aggregation model for PPI from the PPI stage-of-processing (SOP) system. The FD-ID system offers more overall measurements than the SOP system since it includes indices for services, construction, exports, and government purchases.

How to Calculate the PPI Index

A key economic statistic that captures price changes from the viewpoint of sellers is the Producer Price Index, or PPI. The formula used to compute it divides the current prices that producers receive for a chosen basket of goods and services by the prices of the same goods and services in a base year. To obtain an index value, this computation is then multiplied by 100.

One important economic statistic that shows price changes from the viewpoint of sellers. An important indicator of the average prices that producers get for their domestically produced goods and services is the PPI. Economists and researchers can learn more about inflationary tendencies and a nation's general economic health by examining the index's variations over time. Additionally, this data may offer useful insights into shifts in market dynamics and production costs, which may have an impact on pricing policies and economic policy choices. In the end, the Producer Price Index (PPI) is an essential instrument for comprehending the pricing environment that producers encounter and how this impacts the whole economy.

The impact of the PPI index on the inflation rate

To evaluate different aspects of inflation, a variety of indexes have been developed, each intended to capture distinct aspects of how prices fluctuate over time. The basic definition of inflation is the state in which prices in an economy as a whole are steadily rising. Accordingly, when prices rise, money's purchasing power decreases, creating a situation where consumers can purchase less with the same amount of money than they could previously.

The Producer Price Index (PPI) is a crucial instrument among the various metrics at hand. By keeping an eye on the prices that producers get paid for their goods at earlier points in the production process, it precisely measures inflation. By illustrating how shifts in production costs may ultimately affect consumers through product prices, the PPI acts as an early warning sign of inflationary trends.

Why is the PPI important?

The producer price index (PPI) is a key economic indicator in the industrial sector to measure inflation, and it focuses on the costs incurred by producers of goods and services. It provides vision into wholesale price changes before they are passed on to clients as retails prices. The PPI can be used to forecast future inflationary trends because it tracks price fluctuations among producers.

Many economic and financial analysts believe that it is a better indicator of inflation than the consumer price index (CPI) because it captures the cost pressures faced by manufacturers before reaching the end user. So we can consider that changes in PPI can be an early indicator of changes in CPI, implying that rising costs for manufacturers lead to higher prices for end users.

As a result, the PPI exposes direct economic issues/pressures on the production side while also serving as a predictive measure to alert policymakers, businesses, and investors to prospective inflationary patterns that may impact overall economic stability and consumer purchasing power in the future.

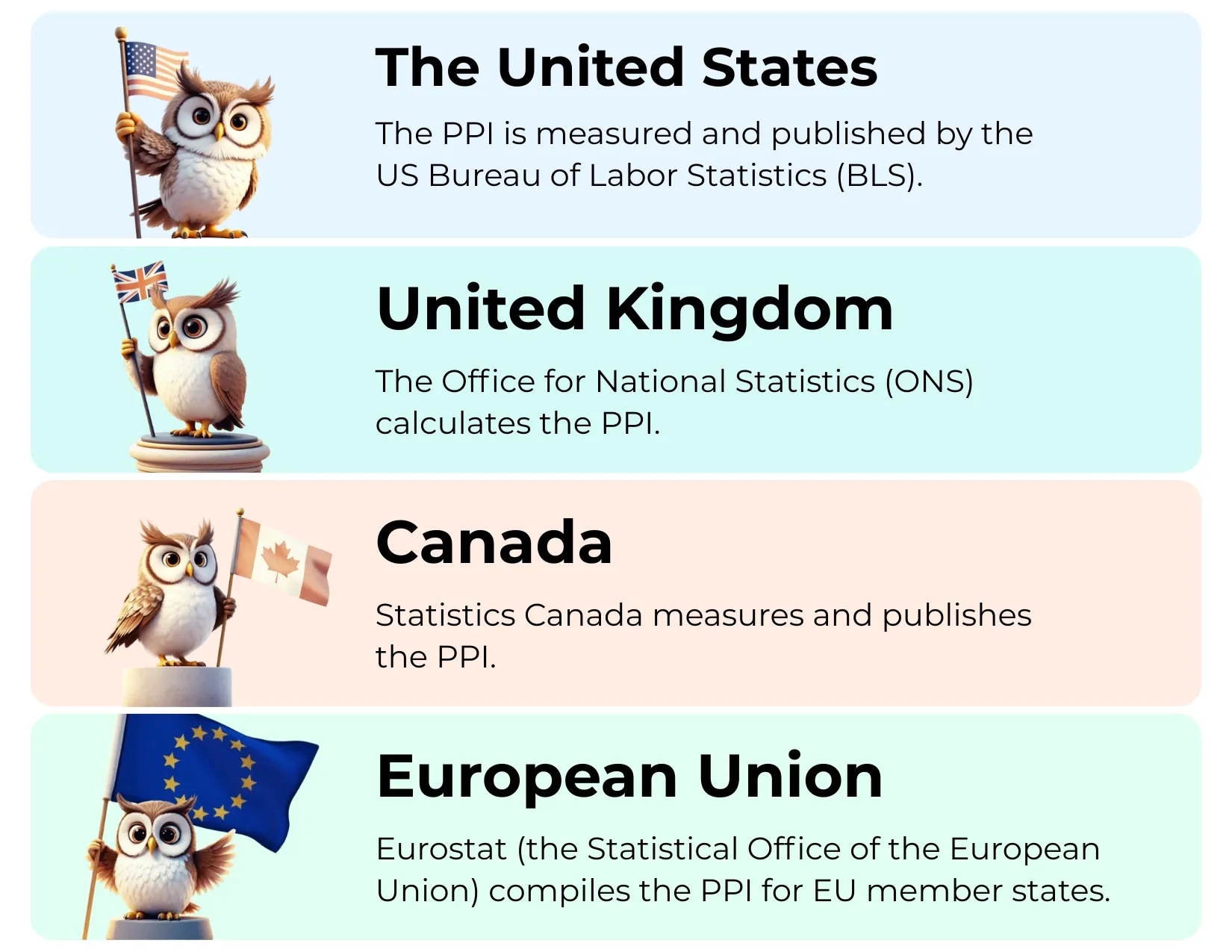

Who measures the PPI?

Usually, national statistics agencies or governmental entities are in charge of economic data measuring the Producer Price Index (PPI) and releasing PPI news. Examples for a few major countries are as follows:

When is the PPI Released?

The timing of PPI news releases varies between countries, but it is typically released monthly. Here are some examples:

The United States

When: About the middle of each month.

United Kingdom

When: Around the third week of each month.

Canada

When: Toward the end of the month after the reference period.

The European Union

When: Early in the month, usually covering data from two months ago.

The impact of the PPI index on Forex

As previously mentioned, the PPI news is a significant financial metric that tracks the average shift in the fees that producers and manufacturers receive over time for the goods and services they provide to customers. It makes understanding the state of the economy, particularly the rate of inflation, much simpler. Forex traders can learn much about how price fluctuations move the overall economy. For example, rising PPI forex may indicate for FX traders that producers are incurring higher costs, which could lead to higher end-user pricing. This may lead to an increase in purchasing power, which affects spending patterns and, thus, inflationary pressures.