What is a Currency Strength Meter

A currency strength meter is an essential tool in financial trading that measures and displays the relative strength or weakness of a specific currency, such as the USD, GBP, EUR, CHF, JPY, CAD, NZD, and AUD, in the foreign exchange (Forex) market. This tool is designed to assist traders in making more informed decisions about which direction a currency pair is likely to trend in the future. By analyzing how a particular currency performs against a basket of other currencies over a set period, traders can identify trends and potential opportunities for buying or selling. Currency strength meters provide a visual representation of market conditions and help traders assess whether a currency is strengthening or weakening relative to others. This insight enables traders to choose strategies that align with the current market environment, improving their ability to capitalize on profitable trades. Overall, using a currency strength meter can enhance a trader’s analysis and decision-making process.

How does a currency strength meter work?

In general, the Currency Strength Meter indicates the relative value of one currency compared to another. To understand why one currency has appreciated against another, several influencing factors must be examined, such as interest rates, inflation, economic performance, political conditions, unemployment rates, and also the supply and demand for a currency.

All of these elements, along with others, contribute to the increase or decrease in a currency’s price, which subsequently causes changes in the readings and figures displayed on the Currency Strength Meter.

The currency strength chart will vary depending on the time frame you set, as exchange rate fluctuations occur over time. For example, in the past month, the USD may have appreciated against other currencies. However, over a shorter time frame, the EUR might show a higher growth rate compared to the USD, causing the chart to shift accordingly.

Types of currency strength meter

There are two primary types of currency strength indicators in the Forex market: 1. Fundamental and 2. Technical.

The fundamental analysis focuses on economic factors that influence a country’s currency. It takes into account key indicators such as economic growth, interest rates, inflation, and political stability. These factors help traders assess the overall health of an economy and its currency’s potential strength. For example, higher interest rates often attract foreign investment, boosting demand for that currency.

On the other hand, technical analysis relies on historical price data to assess currency strength. By studying past price movements, traders use charts and technical indicators (like moving averages, RSI, and MACD) to identify trends and forecast future price behavior. This method doesn’t concern itself with economic fundamentals but rather the market’s price action over time.

How is currency strength calculated?

The value of a currency is measured via its exchange rate to other currencies. Exchange rates in the forex market are shaped by a range of factors: including interest rates, trade balances, inflation levels, geopolitical developments, GDP growth, the dynamics of supply and demand, and overall market sentiment.

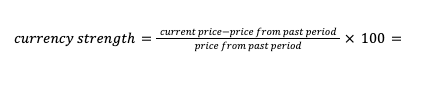

Although it’s not crucial to know the exact calculation behind the numbers in a currency strength meter for trading, if you’re interested in understanding it, you should follow this formula:

Example:

Example:

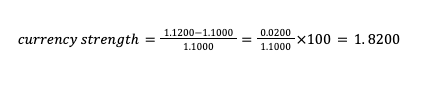

Suppose the EUR/USD price was 1.1000 in the past, and it is now 1.1200. To calculate the strength of the euro against the dollar:

This means the euro has appreciated by 1.82% against the dollar

This means the euro has appreciated by 1.82% against the dollar

Reading and interpreting a currency strength meter

Reading and interpreting a currency strength meter is essential for understanding the relative strength of different currencies in the Forex market. Here’s how you can interpret the data:

1. Understand the Scale and Visualization

• A currency strength meter typically displays a scale where currencies are represented by either numerical values, bars, or color codes. The meter shows the strength of various currencies in real-time, often comparing multiple currencies against each other.

• Stronger currencies are usually shown in green or represented by higher numbers, while weaker currencies are shown in red or with lower numbers.

2. Interpreting the Numbers

• Higher Numbers or Green Color: These indicate a strong currency. For example, if EUR shows a strength of 75, it means the euro is strong compared to other currencies. A currency strength meter could represent this by showing the EUR as the strongest currency among others.

• Lower Numbers or Red Color: These indicate a weak currency. For instance, if USD has a strength of -50, the U.S. dollar is weak relative to other currencies, and this would appear in red on the meter.

3. Compare Relative Strength

• Cross-Currency Comparisons: The meter shows the strength of each currency relative to others. For example, if the USD is strong (say 80) and the EUR is weaker (say 50), then the USD is outperforming the EUR, and you may consider trading currency pairs like EUR/USD accordingly.

• Currency Pairs Impact: The strength of the base currency in a pair (the first currency) is considered the most important. For example, in the EUR/USD pair, if the EUR is strong and the USD is weak, the pair is likely to go up, which indicates a bullish trend for EUR/USD

Why Use a Currency Strength Meter in Forex Trading?

The reason traders use the currency strength meter in their trading is as follows:

For instance, you don’t need to track all the news and factors affecting currency prices. Instead, you can focus on key elements that matter. A currency strength meter allows you to monitor and compare the relative strength of multiple currencies simultaneously on your screen, helping you choose the most suitable currency pair for your trades.

The strength of a currency displayed in the meter depends on the perıod you select. For example, based on Daıly timeframe, the EUR might be one of the strongest currencies. However, in a monthly analysis, it could be among the weakest. Depending on your trading style (scalper, mid-term, long-term) you have to use different time frames.

how to use currency strength meter to trade

The currency strength meter is not the only tool needed for Forex trading; it is simply one of the tools that provides additional insights to help us execute trades more accurately.

For example, consider a scenario where major Forex currencies are experiencing their highest volatility. Analyzing the rise and fall of a currency’s strength on the meter over the past year would not be an ideal approach in such a scenario.

Therefore, in addition to using the currency strength meter, you also need to rely on technical analysis and fundamental analysis to make well-informed trading decisions.

Best CSM indicators for forex trading

The best Currency Strength Meter (CSM) indicators for Forex trading are tools designed to measure the relative strength or weakness of currencies in real time. These indicators are essential for identifying potential trading opportunities by showing which currencies are strong or weak relative to others.

• Scalping or Day Trading: Use real-time CSMs like MT4/MT5 or TradingView indicators.

• Swing Trading: Opt for advanced tools like Accustrength or Currency Heatmaps for multi-timeframe analysis.

• Custom Strategies: Consider using Excel-based meters or custom TradingView scripts.

These indicators, when combined with other tools like technical analysis (e.g., RSI, MACD) and fundamental analysis (e.g., news, interest rates), can significantly enhance your trading strategy