Market Analysis 30 Apr 2025

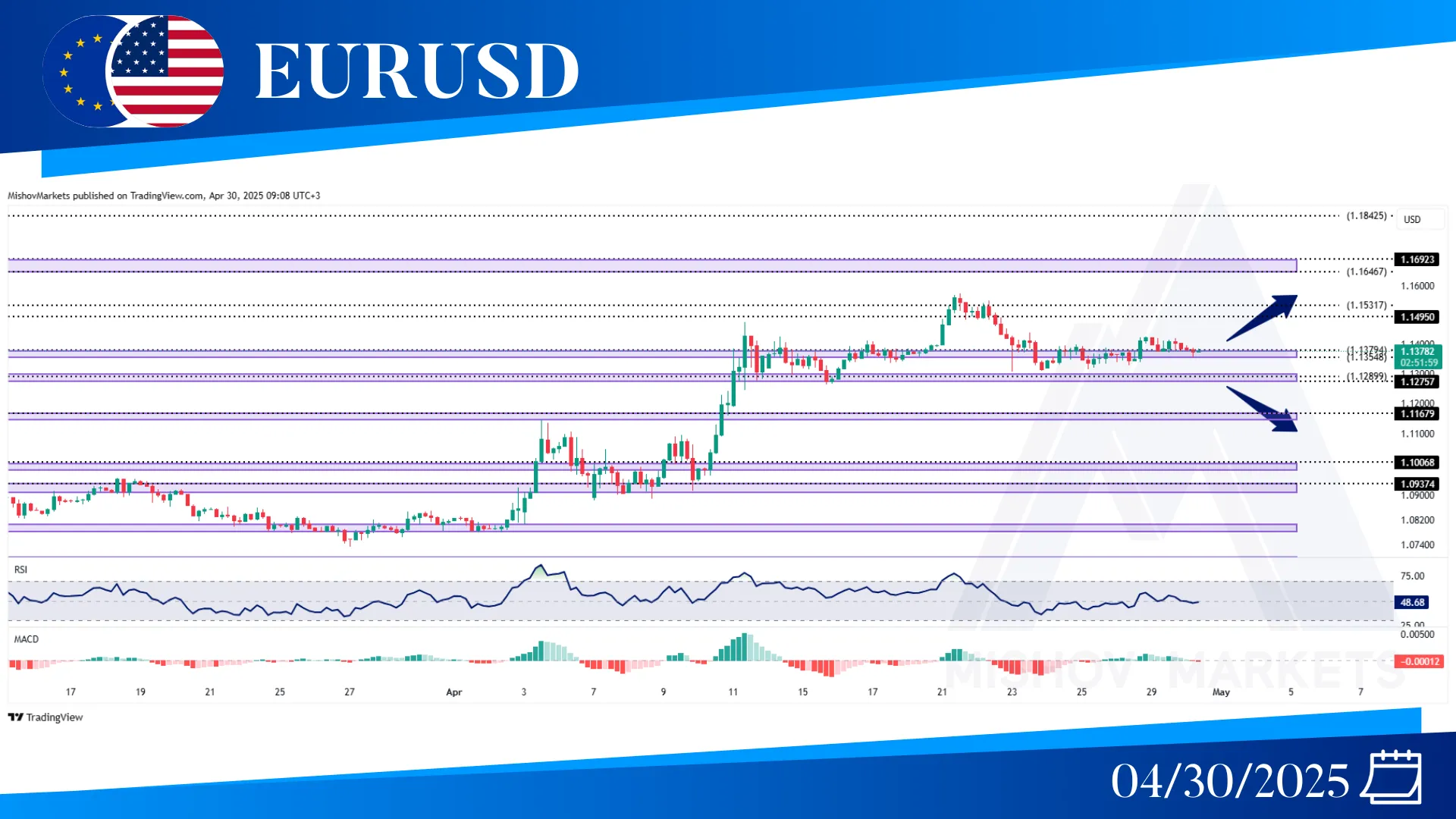

In EURUSD, as mentioned in Monday’s analysis, the price is consolidating and is waiting for more clarity in the economy. If the price starts a new bullish trend from the 1.13540 or 1.12890 zones, then it can reach the 1.14950-1.15310, 1.16460-1.16920 and 1.18420 zones. But if we have a price close below 1.12500, then it can start to decrease toward 1.11670, 1.10060, 1.09370 and also the 1.0800 zone.

In WTI, as mentioned in Monday’s analysis, the 61.160-61.500 zone failed to support the price and it has broken below 61.150. Now the price is attempting to close below 59.500; if successful, it may move toward the 58.170-58.680 and 55.840 zones. In the other scenario, if the 58.170-58.680 zone supports the price, then it can increase once more toward 61.160-61.500 and after that, it could continue to move toward 62.300 and 64.500. If we see a close above this level, then it can reach the 65.710 zone.

In XAUUSD, as mentioned in Monday’s analysis , the 3259-3270 zone acted as support for the price and pushed it higher toward our zone at 3359. Now the price is trading in a range between these two zones (3259-3270 and 3359-3368), and traders should wait until the price breaks from one side and starts its trend. If the 3359-3368 fails to act as resistance, then the price can continue to move toward bullish targets like the 3399-3408, 3448, 3500-3505, and 3580-3616 zones, but if we see a strong price close below the 3255 zone, then it can decrease more toward 3224-3213, 3182-3173, 3151-3145, and further toward 3110-3094.

In the S&P 500, the situation remains unchanged from Monday’s analysis, with the price consolidating and the market demanding more clarity. If we see a strong close above 5550, the price might continue to move forward to 5705-5720, 5810-5840, and 5915. If we see a close below 5100, then it can move toward the 5010-4947 zone or the 4880-4851 zone once more. And if these zones fail to support the price, then it can decrease further to the 4710-4680 and 4575-4535 zones.