Market Analysis 24 Mar 2025

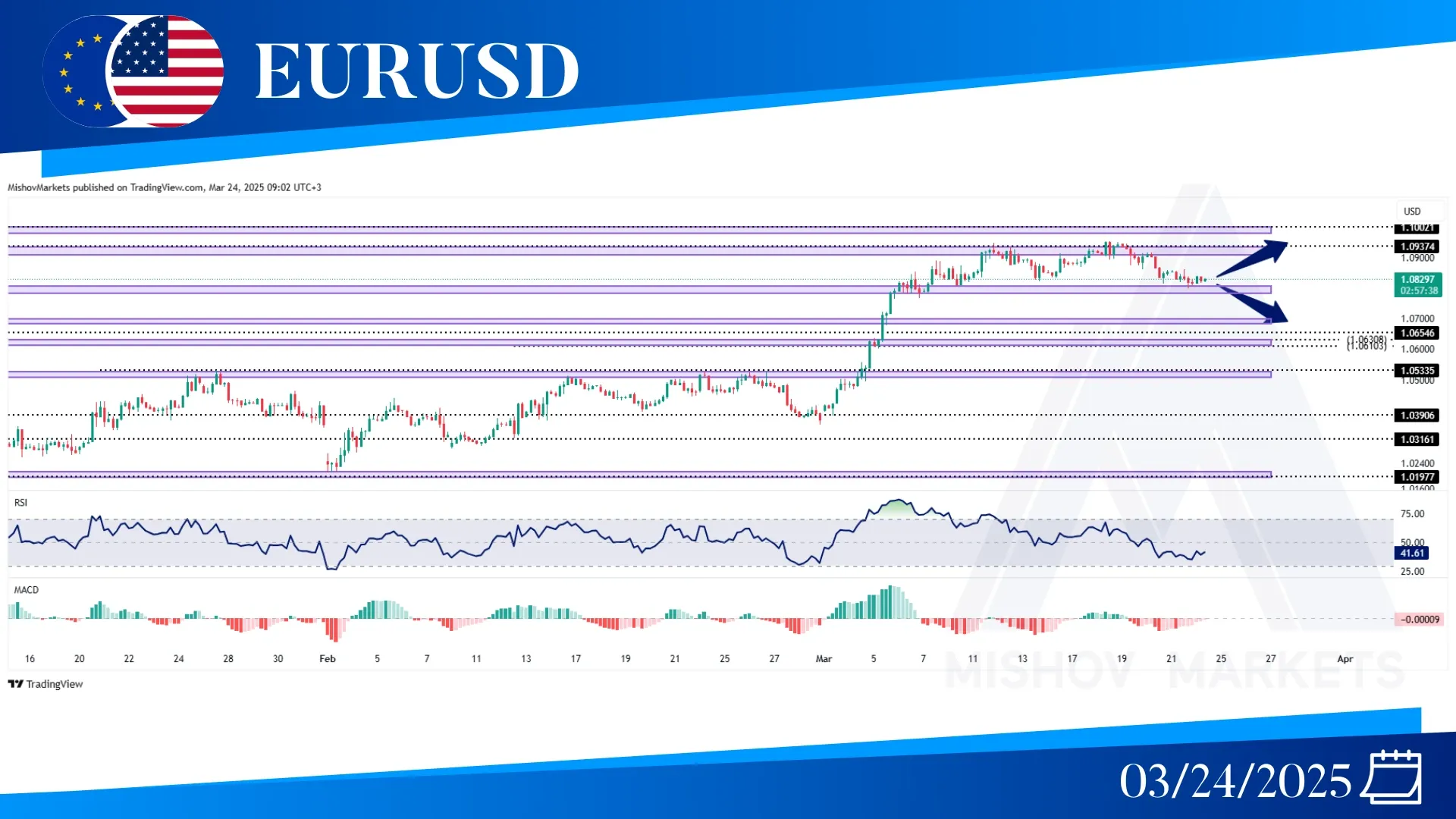

In EURUSD, the price got rejected from our zone at 1.09070-1.09370. If the price receives support and continues its strong bullish momentum from our zone at 1.08060-1.07620 then we have a target zone at 1.09070-1.09370, 1.09820-1.10000, as well as 1.11450-1.11690. But if we see a price close below 1.07600, then we have targets at 1.06950-1.06820 and 1.0630-1.0610; also, the price might decrease further and toward the 1.05270-1.05100 zone.

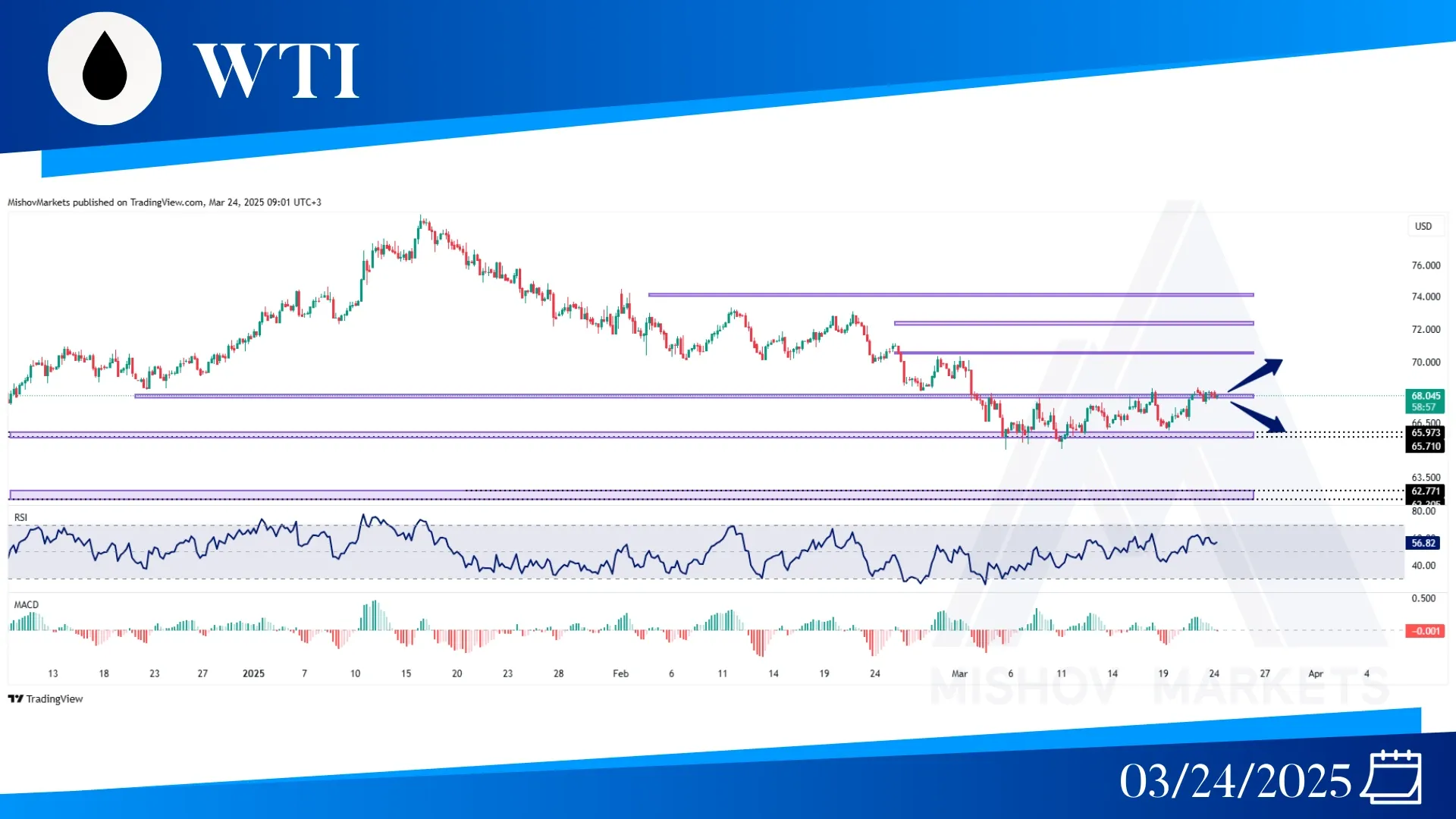

In WTI, as mentioned in Wednesday’s analysis, the price is trying to close above 68.820; if it fails, it will return to our range between 65.810 and 68.00. A close above 68.820 could result in bullish trend toward our targets at 70.510, then 72.285, and also 74.270 and If the price breaks below our support zone at 65.810, the price can continue its bearish movement toward our support at 62.770-62.010, and also 60.590.

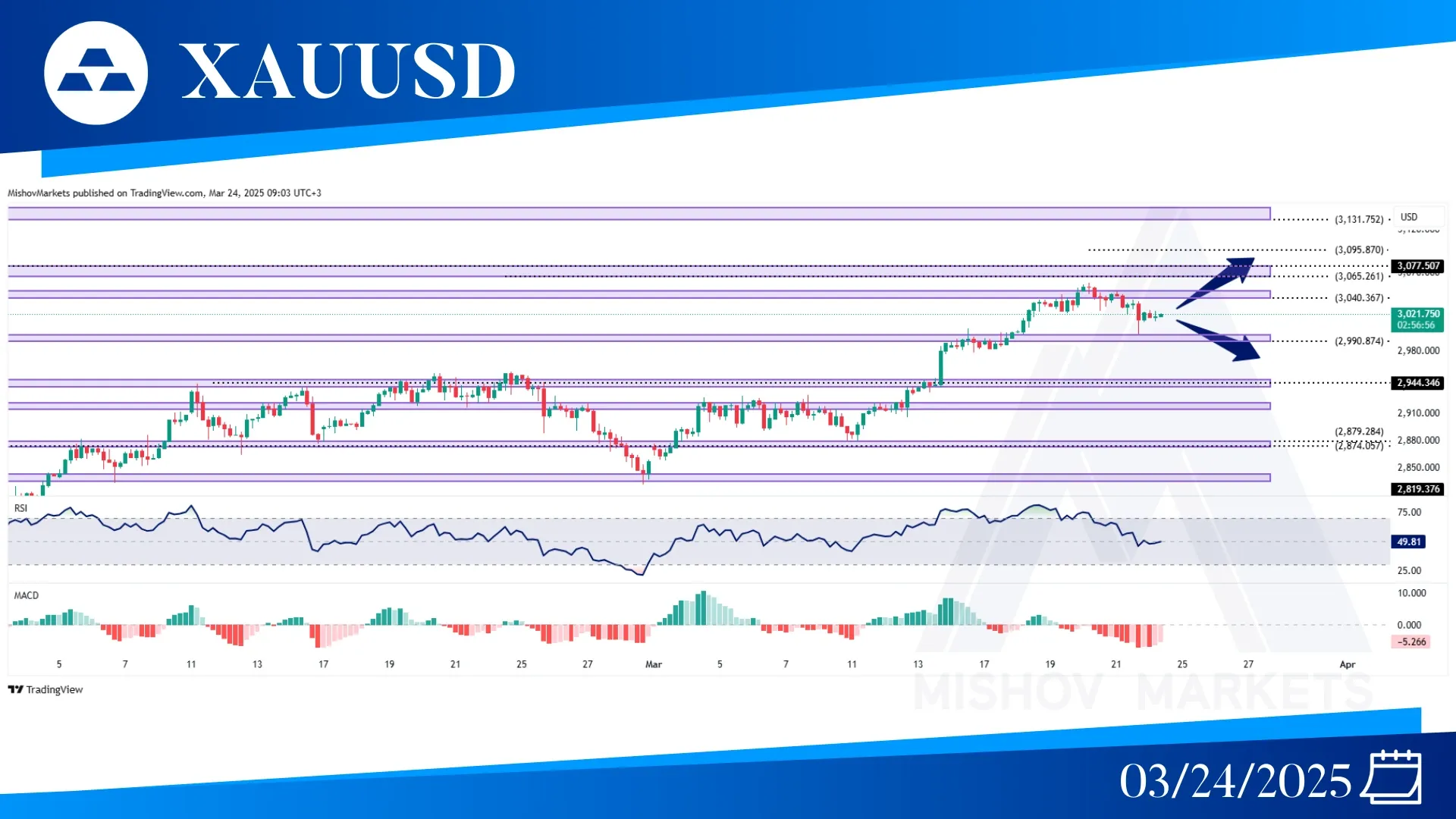

In XAUUSD, as precisely predicted on Wednesday’s analysis, after the price broke below 3027, it reached our zone at 2997-3001 and received good support from this zone as well, but if the conflicts in the Middle East expand, then the price could start another bullish movement and reach our targets at 3040-3044 and also 3065-3077. But if the price breaks below 2990, it could reach 2944 and 2920 as well.

In the S&P 500, as mentioned in last week’s analysis, the price is trying but is still unable to give us a strong close above 5750 for the bullish movement, but if it does, then the price could continue toward our bullish targets at 5902 and 6069. But if the price got rejected from this zone and we see a close below the 5592 zone and it moves lower, then we have targets at the 5349-5336 zone.