Market Analysis 23 Jun 2025

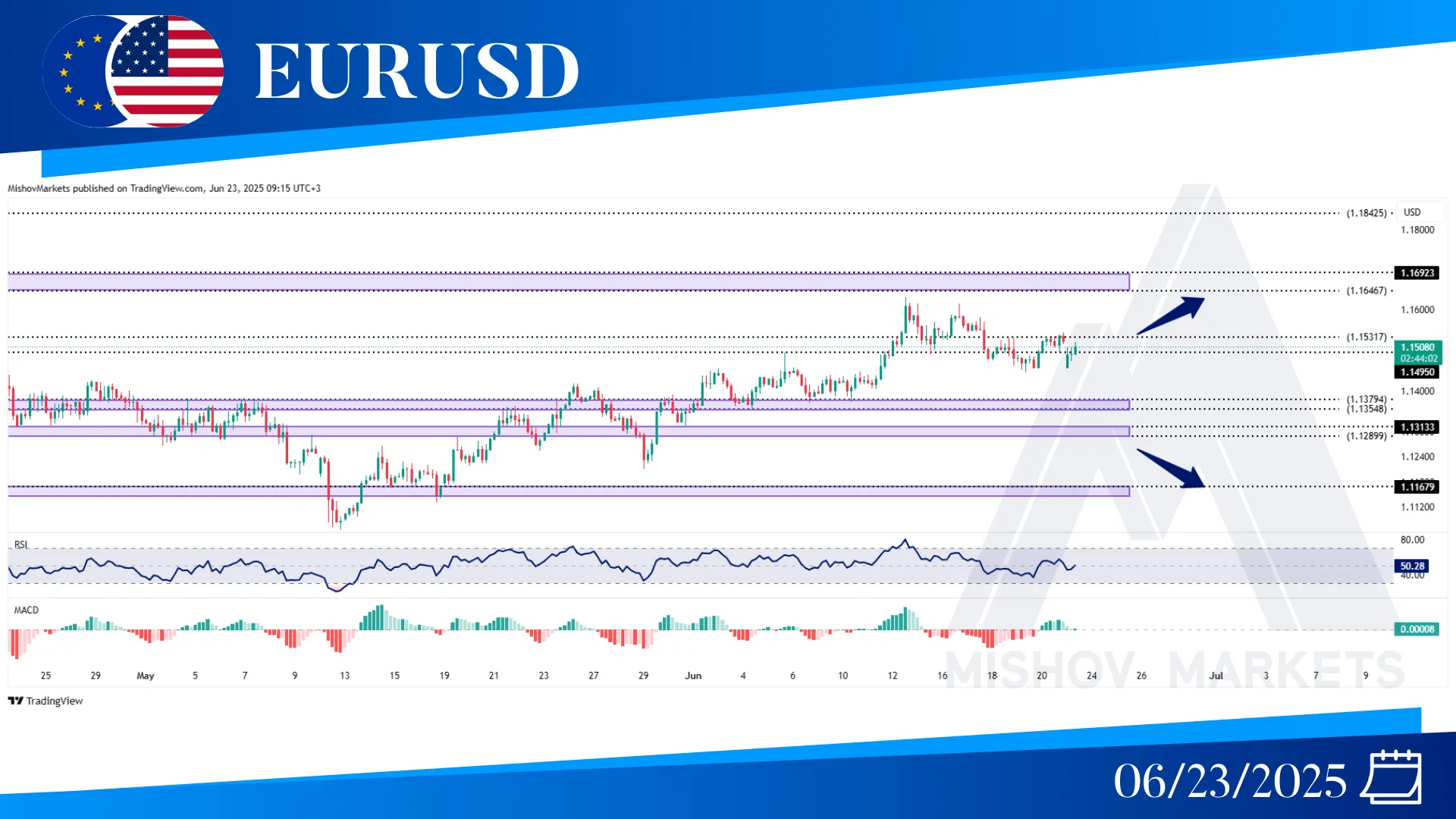

In EURUSD, as mentioned in Wednesday’s analysis, the price is testing the 1.14550–1.15310 zone to receive support and move toward the 1.16460–1.16920 and 1.18420 zones. If this zone fails to support the price and a close below 1.14450 occurs, the price could decrease toward the 1.13540-1.13750 zone. Additionally, if it breaks below this zone, it may move further down to the 1.12890 and 1.11670 zones. If the price closes below 1.11300, it could decrease even further toward the 1.10060, 1.09370, and possibly reach the 1.0800 zone.

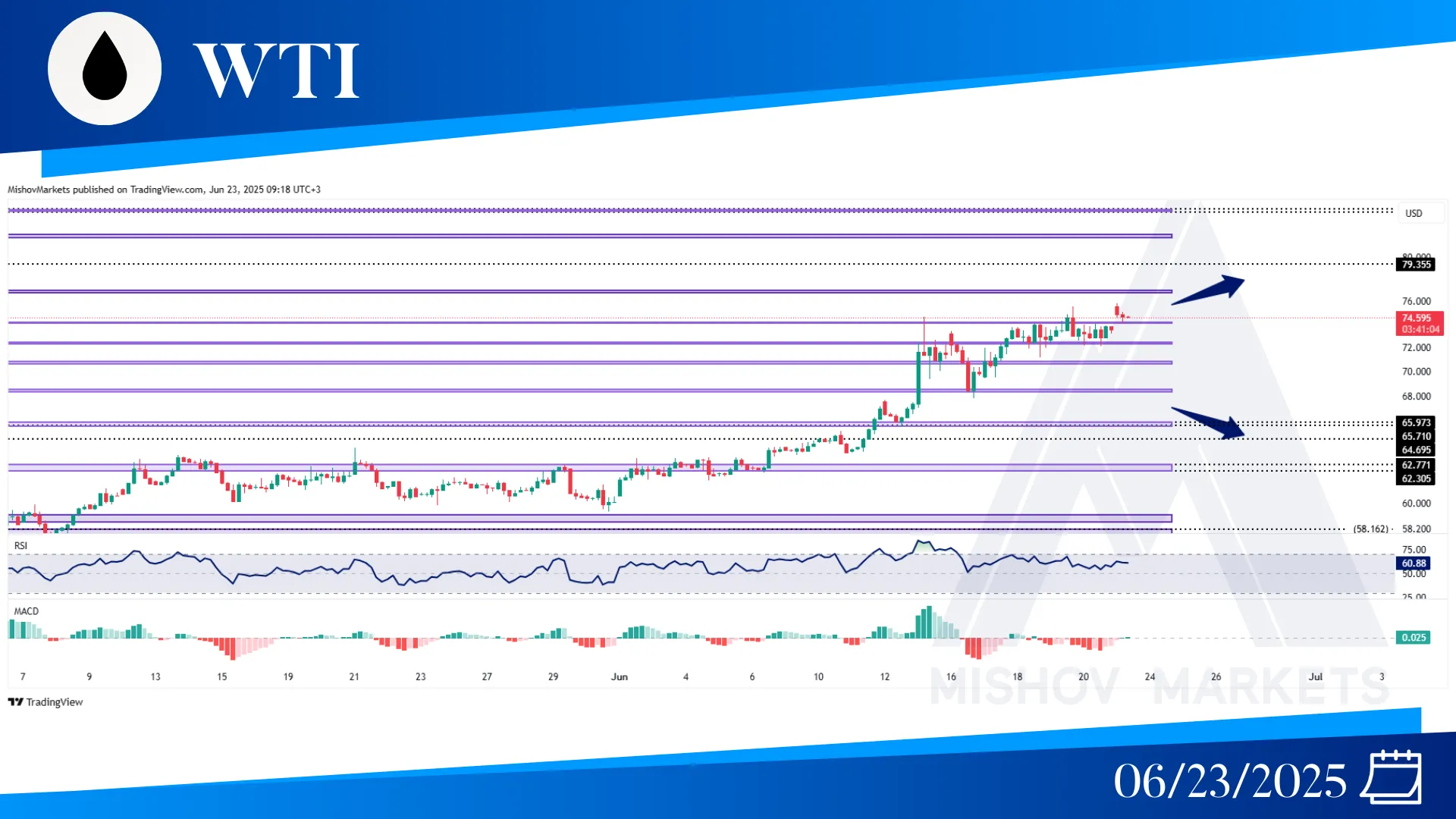

In WTI, as precisely mentioned in Wednesday’s analysis, due to the geopolitical conflicts, the price reached our targets at 74.00-74.300. Now it is trying to continue its bullish trend toward the 76.770-77.110, 79.350, 81.900-82.200 and 84.370-84.650 zones. But if the price forms a close below 67.700, it could start to decrease further toward 65.970-65.710 and 64.690.

In XAUUSD, as precisely mentioned in Wednesday’s analysis, the price provided a close below the 3366 zone and then reached our targets at 3359 and 3345-3334. Then it received support from the 3345-3334 zone and soared toward our bullish target at 3393. Now the price is trying to return and test the 3345-3334 zone for support. If the price provides a close below the 3312 zone, it could reach 3289, 3247, and 3224. But if the price receives support, it could increase further and reach our targets at 3405, 3448, 3491-3501, 3580-3592, and 3615.

In the S&P 500, as mentioned in Wednesday’s analysis, the price is still trading around the 5973 zone. If this zone acts as a support, the price could continue its bullish momentum toward the 6041-6068 and 6120-6136 zones. But if the 5973 fails to support the price and it provides a close below the 5910, then it could decrease toward the 5896-5875, 5815-5788, and 5690-5672 zones. Also, traders should still be cautious due to U.S. military actions in the Middle East, which can directly affect the financial markets.