Market Analysis 21 May 2025

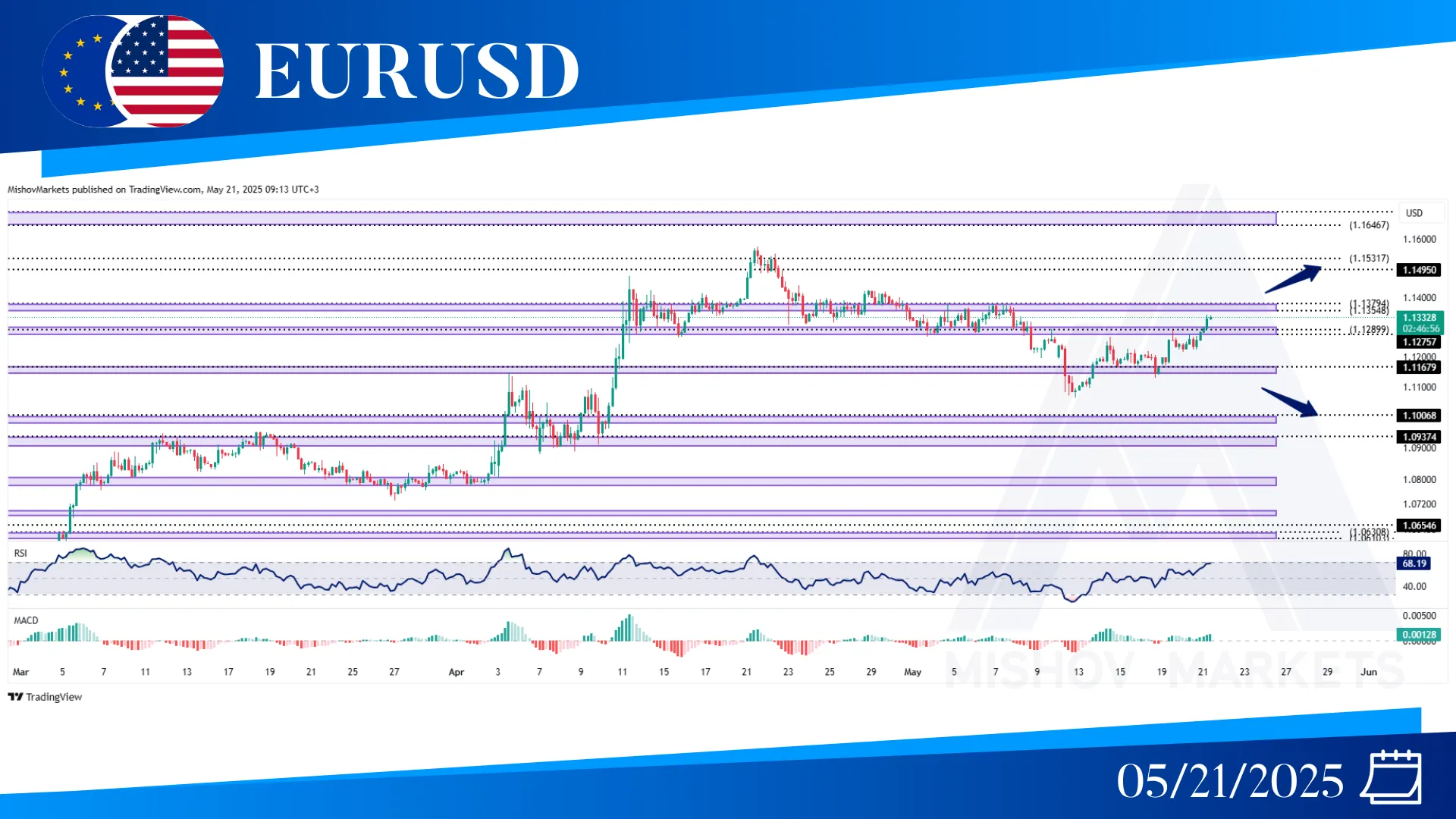

In EURUSD, as mentioned in Monday’s analysis, the price broke above the 1.12899 zone and it has reached 1.13540. Now if it breaks above this zone with a close above 1.14350, then it could reach the 1.14950–1.15310, 1.16460–1.16920, and 1.18420 zones. But if the price comes below the 1.11670 zone and breaks it with a close below 1.11300, then it could decrease further toward 1.10060, 1.09370, and also the 1.0800 zone.

In WTI, as mentioned in Monday’s analysis, the price is trying to break above the 62.300-62.770 zone and if we observe a close above 64.750, then it could reach our next targets at the 65.700-65.970 and 68.280-68.500 zones. But if it fails to do so, then it could start to retrace some of its movements and move toward the 59.200–58.800 and 58.140–57.600 zones to receive support from them.

In XAUUSD, as precisely mentioned in Monday’s analysis, the price broke above the 3239-3247 zone with a close above 3270 and then started moving toward our targets at the 3298 and 3301-3305 zones. Now the price might come back to test the 3247-3239 zone for support and then continue to move toward the 3384, 3393-3405, and 3448 zones. But if the 3239–3247 or 3220–3211 zones fail to support the price and we observe a price close below 3150, then it could decrease further toward the 3112–3097, 3077, 3054, and 2996–2988 zones.

In the S&P 500, as mentioned in Monday’s analysis, the price is being held at the 5973 zone and it is necessary for it to break above this zone to continue its bullish trend and reach our next targets at the 6041-6068 and 6120-6136 zones. However, if the 5973 zone acts as resistance, the price may return to test the 5838-5814 or 5692-5674 zones; if these zones do not support the price and a close below the 5571 zone occurs, then it can further decrease toward the 5269-5227, 5115, and 5010-4947 zones.