Market Analysis 19 Mar 2025

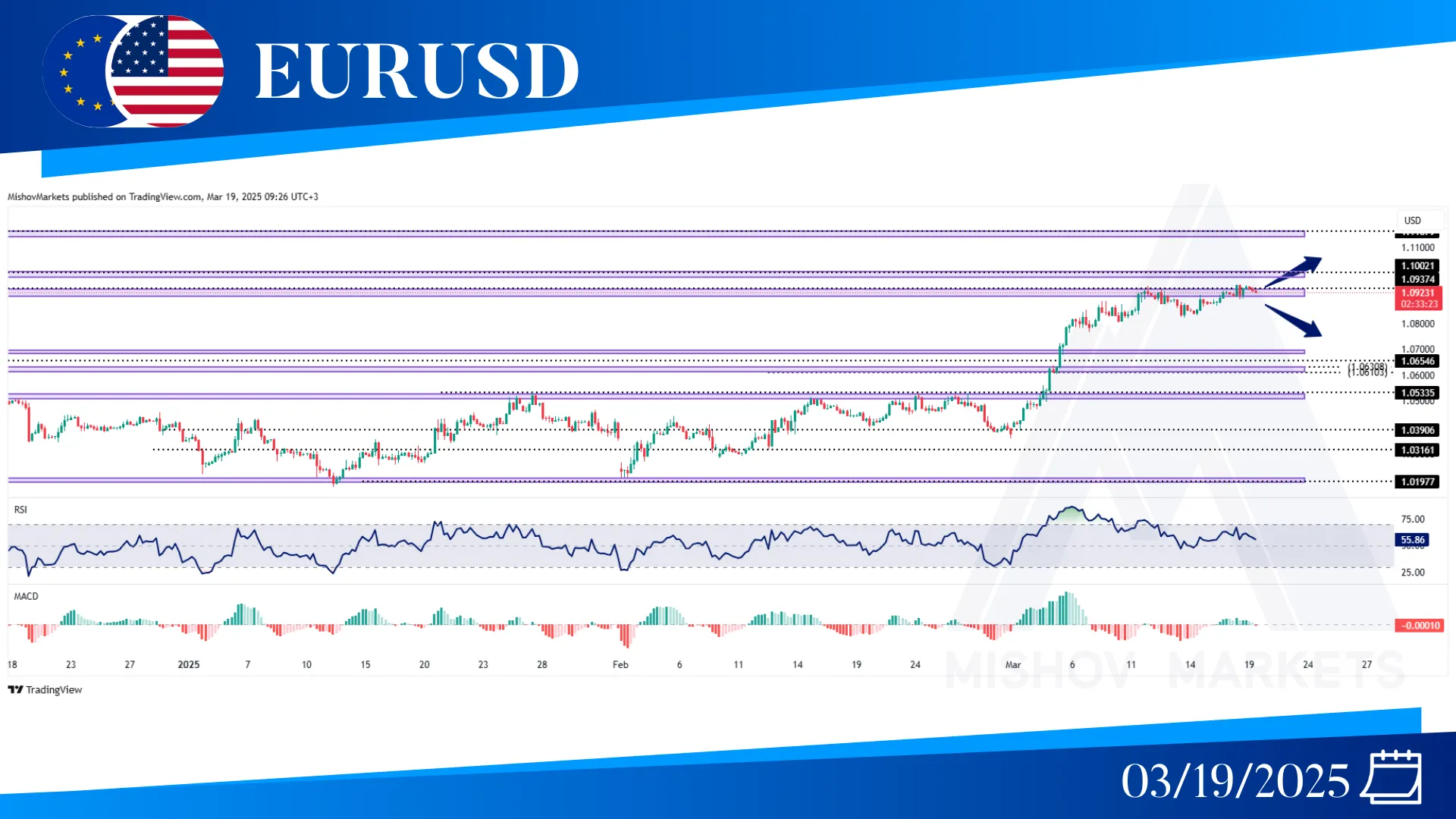

In EURUSD, the price is stocked in our zone at 1.09070-1.09370. The world’s economy is facing too many risks, and traders should wait for more clarity in the market, but if the price continues its strong bullish momentum, we have a target zone at 1.09820-1.10000, as well as 1.11450-1.11690. But if the price starts to retrace its bullish movement, we have targets at 1.06950-1.06820 and 1.0630-1.0610; also, the price might decrease further and toward the 1.05270-1.05100 zone.

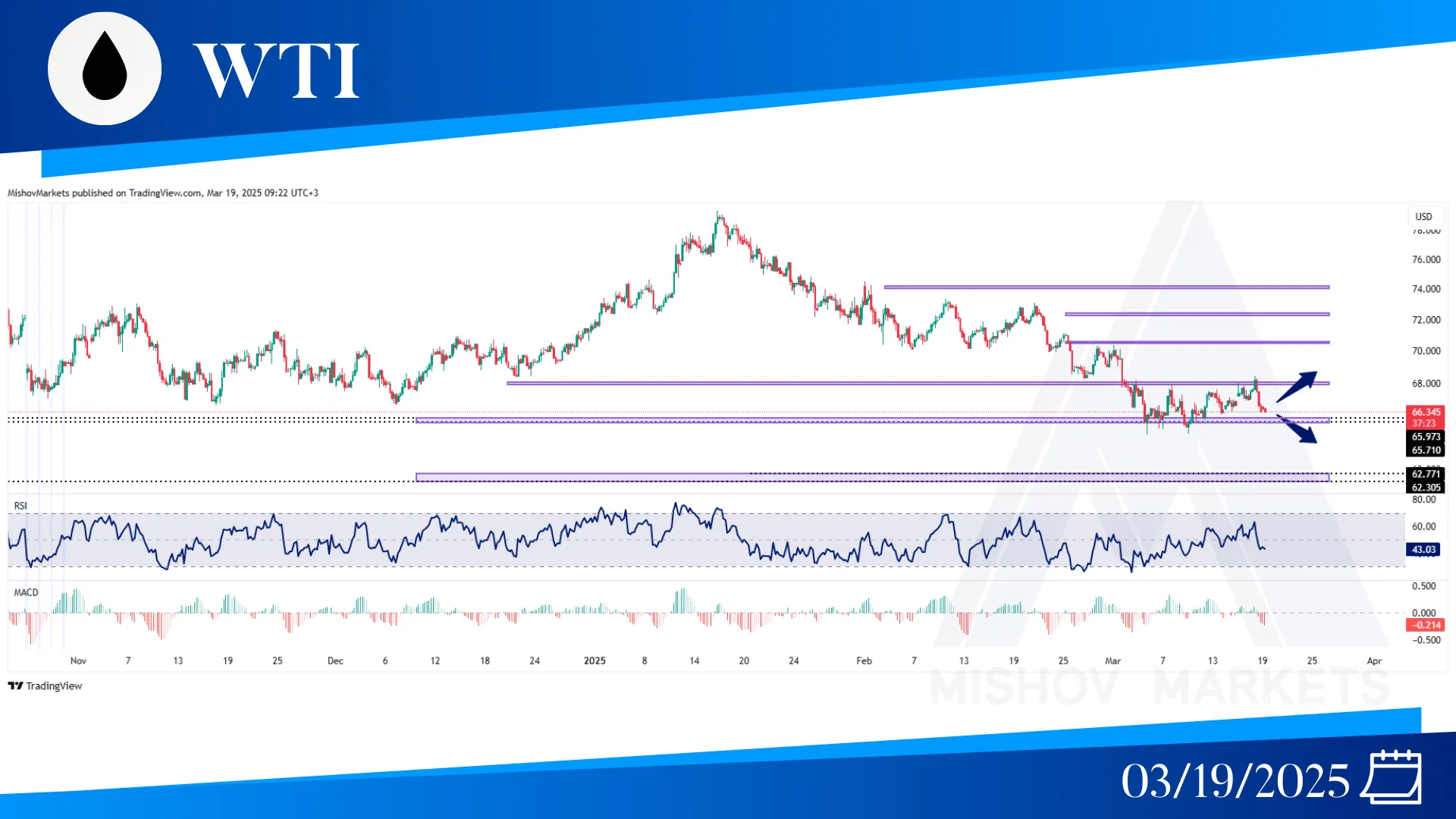

In WTI, as mentioned in Monday’s analysis, the price was unable to close above 68.820, and now it has returned in our range between 65.810 and 68.00. Now traders should be patient for the price to exit from either side of this trading range. A close above 68.820 could result in a bullish trend toward our targets at 70.510, then 72.285, and also 74.270 and If the price breaks below our support zone at 65.810, the price can continue its bearish movement toward our support at 62.770-62.010, and also 60.590.

In XAUUSD, as conflicts have risen in the Middle East, the price started another bullish movement and reached our target at 3027-3031. If the price bullish momentum continues, then our targets are 3065-3077 and 3131-3140. But if the price decreases and breaks below 3027, then we can have eyes on 2997-3001 and 2981; further ahead, if retracement continues, we might have targets toward 2951 and 2920 as well.

In the S&P 500, as mentioned in Monday’s analysis, the price was unable to give us a strong close above 5672 and returned toward 5615-5592 zones once more, and now the price is still trading between our zones at 5615-5592 and 5650-5670. For the bullish movements, traders must wait for a close above 5710 before the price continues toward our bullish targets at 5902 and 6069. If the price closes below this range and moves lower, then we have targets at 5349-5336 zone.