Market Analysis 18 Aug 2025

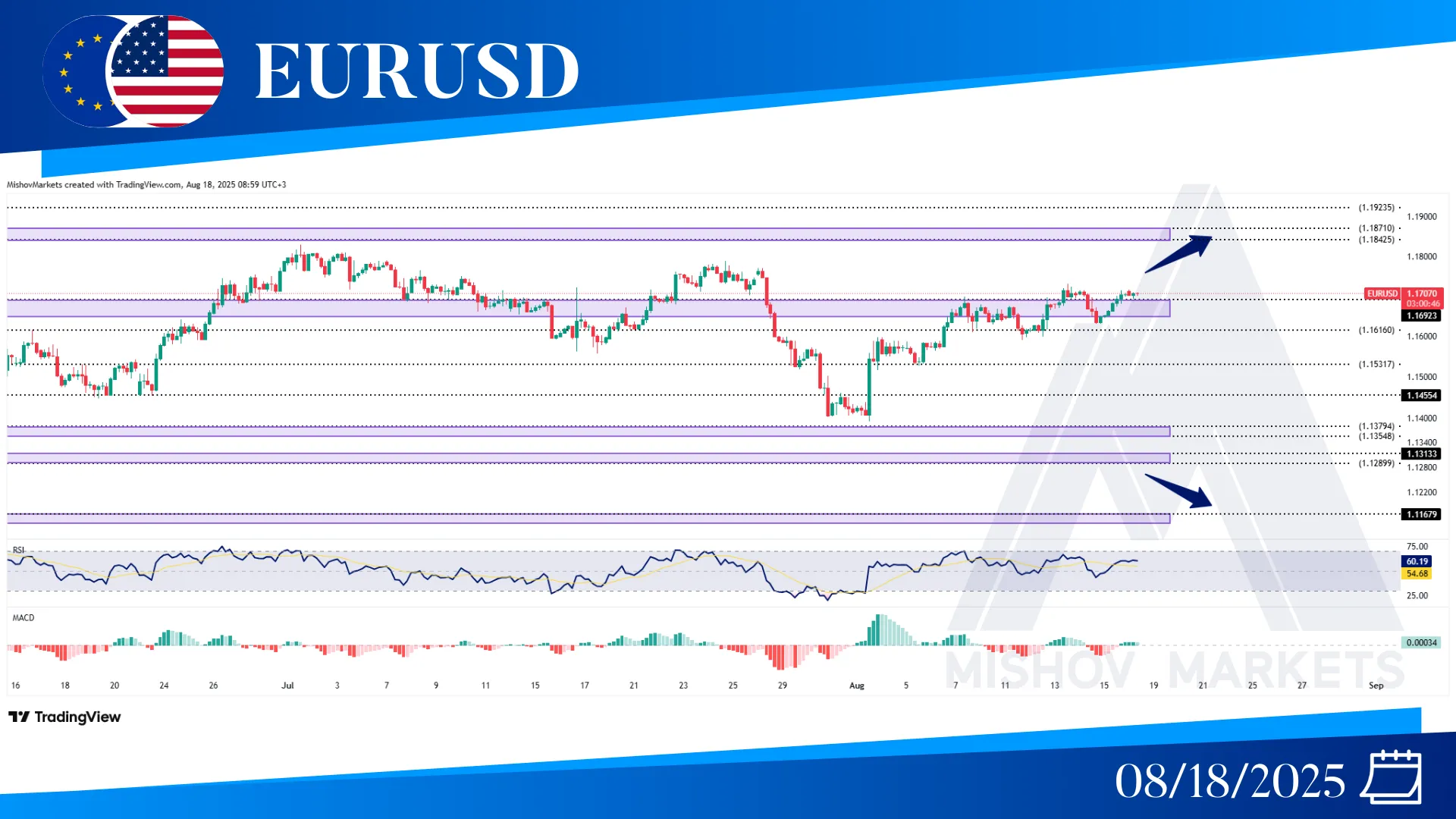

In EURUSD, as mentioned in Wednesday’s analysis, the price is trying to break above 1.16920; if it provides a close above 1.17350, then it could continue to move toward our targets at 1.17455, 1.18420–1.18710, 1.19230 and even 1.20040. But if this zone acts as resistance, then it could start to decrease toward 1.16120 or 1.15310 and if it breaks below these zones, then it could decrease toward our targets at the 1.14550 and 1.13540-1.13750 zones.

In WTI, as mentioned in Wednesday's analysis, the price has moved below the 62.300-62.770 zone. Now if the price provides a close below 61.000, then it could decrease further toward 59.200-58.840 and 57.800-58.100. But if it proves to be a fake breakout and it provides a close above 63.800, then it could continue to increase toward 64.690, 65.970-65.710, 67.790-67.980 and 69.100.

In XAUUSD, as mentioned in Wednesday’s analysis, the price initially increased toward 3368 but encountered resistance and subsequently moved back down to 3330, failing to close below that level. Now the price is still trading between the 3358 and 3330 levels; if it breaks above 3368, then it could continue to move toward 3383, and with a close above 3391, it could continue to increase toward our target at 3398-3407, and if provided a close above this zone, it may increase further toward 3429, 3448, 3490-3500, and 3580. But if it provides a close below 3323, then it could return to test 3314-3305 or 3289 for support. If these zones fail to support, then it could decrease further to 3247, 3213-3224, and 3173-3182.

In the S&P 500, as precisely mentioned in Wednesday’s analysis, the price continued to increase and reached our target at 6478-6456. Now the price is trading between 6478 and 6418; if it breaks above 6478-6456 with a close above 6490, then it could continue to increase toward 6504-6519 and 6598. But if the 6456-6475 level acts as resistance, then it could decrease further toward our targets at 6418, 6361-6364, and 6335-6326 to receive support from them, but if they fail to do so, then it could decrease further toward 6300, 6227-6214, 6177, and 6132-6119.