Market Analysis 15 Sep 2025

In EURUSD, the situation has remained unchanged from Wednesday’s analysis; the price is still trying to break above 1.17500. Now if it receives support from the 1.16930, it could reach 1.18420-1.18710, 1.19230, or possibly 1.20040. However, it might come back to the aforementioned trading range (1.16160-1.17400), but if it falls below 1.15900, it could decrease to 1.15310, and then if this level fails to support the price, it could decrease further toward our targets at the 1.14550 and 1.13540-1.13750 zones.

In WTI, as mentioned in Wednesday's analysis, the 61.400 level is still trying to act as support, but due to geopolitical tensions, we might see abnormal behavior in the chart. If the 61.400 level supports the price, it could rise again toward 64.690 and the range of 65.700-65.970; additionally, if it breaks above the 65.710 level and closes above 66.100, it may continue to increase toward the ranges of 67.790-67.980 and 69.100. But if 61.400-60.990 fails to support the price, then it could decrease further toward the ranges of 59.200-58.840 and 57.800-58.100.

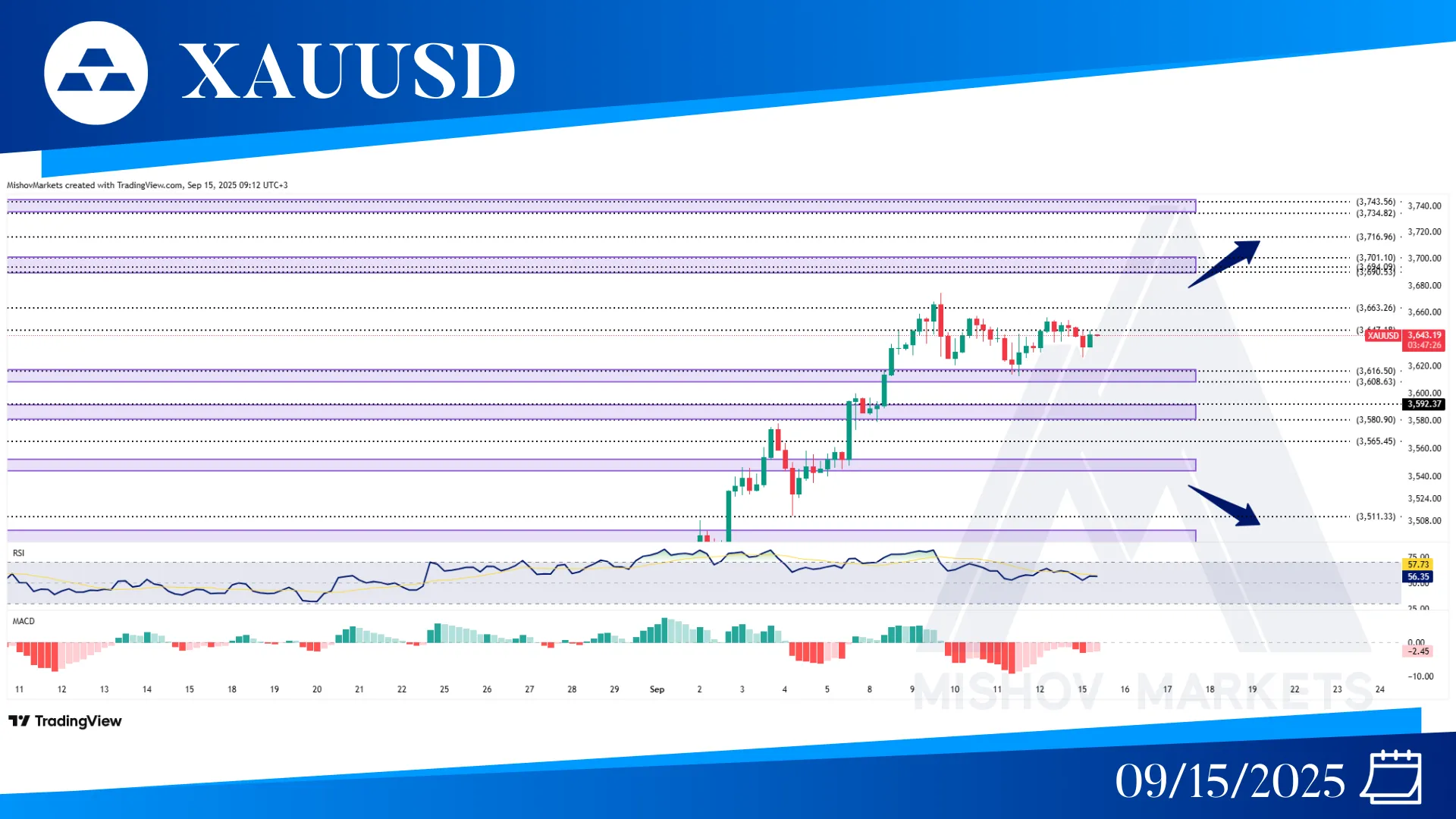

In XAUUSD, as precisely mentioned in Wednesday’s analysis, the price retraced some of the upward movement after facing resistance from 3663 and moved toward our target at 3616-3608 and received support from it, then continued to increase toward the 3647 level. Now if the price continues to increase and provide a close above 3675, then it could continue to move toward 3690-3694, 3701, 3716, and 3734-3743. But if the 3616-3608 zone fails to support the price, then it could start to retrace some of its movements toward 3592-3580, 3565, 3552-3546, 3511, 3501-3490, and 3483 to receive support. At this point if the 3461 fails to support the price, then it could decrease further toward the 3448, 3429, 3409-3400, and 3391-3387 zones.

In the S&P 500, as precisely mentioned in Wednesday’s analysis, the 6519 level acted as support and price provided a close above 6539 and moved toward our targets at 6564-6573 and 6598. Now if the 6598 level acts as resistance, it could decrease and reach our targets at 6573-6564, 6539, and 6519-6504. If any of these zones acts as support or the straight break above 6603, then it could increase toward 6625-6636, 6665, and 6727. But if this zone fails to support the price, then it decreases further toward our target at 6478-6456 and 6418 to receive support, but if these zones also fail to do so, then it could decrease further toward 6361-6364, 6335-6326, and 6300.