Market Analysis 10 Feb 2025

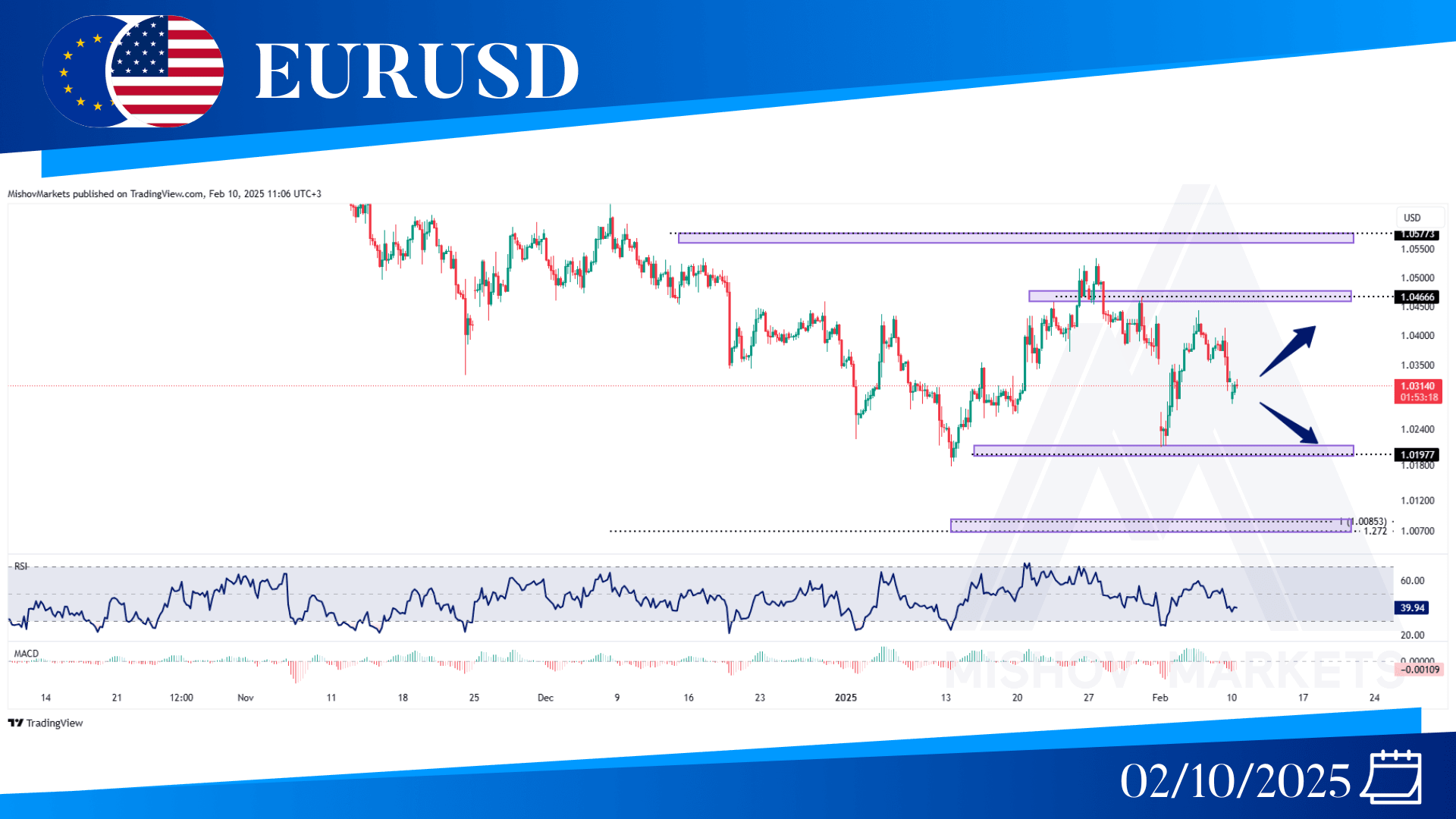

In EURUSD, we are seeing a trading range within our two support and resistance levels. Our last week's zone, which was 1.02150-1.01910, is crucial, as even after the NFP release on Friday, the price is moving towards it once more. We also need to look out for the zone 1.04800 that has rejected the price twice, and this time as well it can act as a QM level, but if we saw a break above this zone, then we could have eyes on 1.05585. Also, if the price break our support zone and we see a close below this level 1.01910 then we can have eyes on our targets at 1.00850 and 1.00680

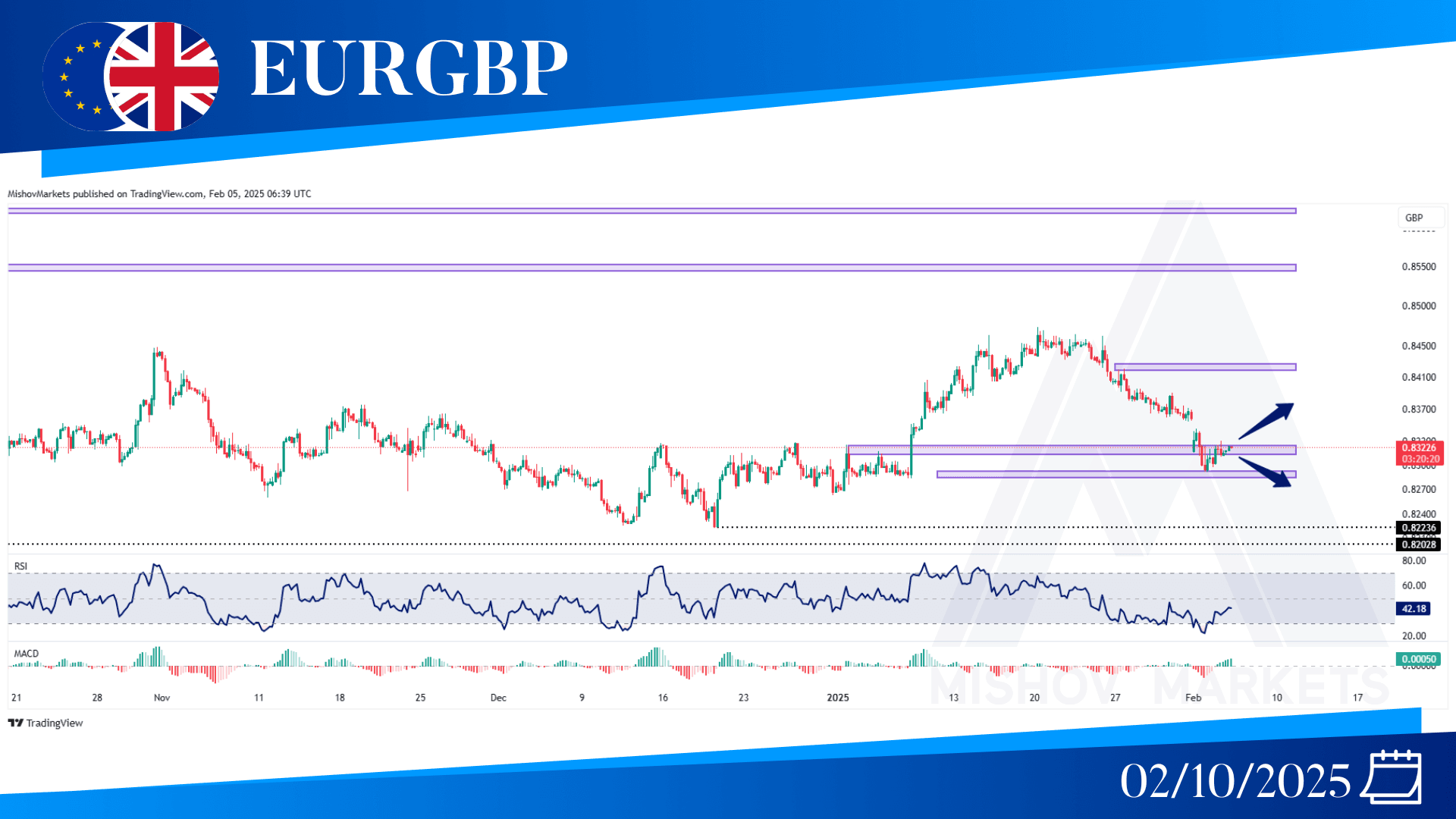

In EURGBP, as told in the Wednesday analysis, price has finally filled the gap we saw on the last weekend. now and after the filing of the gap, the price has come back to our level, if we saw a reversal in price upward momentum and if it closed below of our support zone, then we can wait for our stronger supports like the 0.82230 But we have two price targets if we see strong bullish continuation in price; these are 0.85450 and 0.86220.

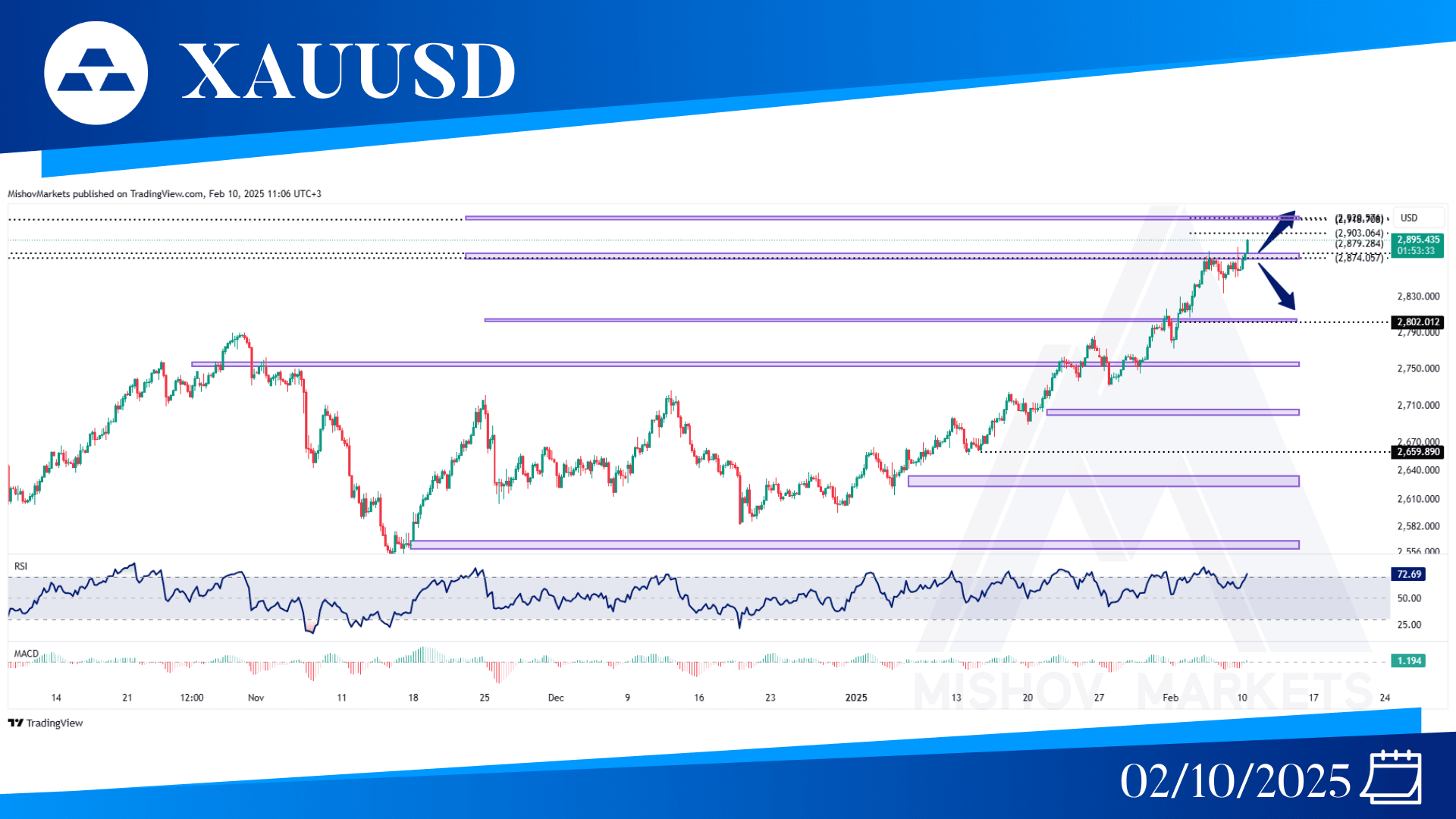

As predicted, XAUUSD is still having a strong uptrend. As mentioned, we had a support at 2781-2787, which pushed the price higher and toward our targets at 2840.50 to 2845.50. Then, as precisely mentioned in last week's analysis, our zones at 2874 and 2884 acted as a resistance and pushed prices downward twice: the first time for 4800 points and the second time for 3800 points, but the trend is still strongly bullish, and we might see higher highs if we close with a 4-hour candle above this zone, and as mentioned in last week's analysis, the next target zones are 2918-2920 and 3013. But if we see a rejection from this zone, we also have some targets for bearish movements at 2815 and 2790.

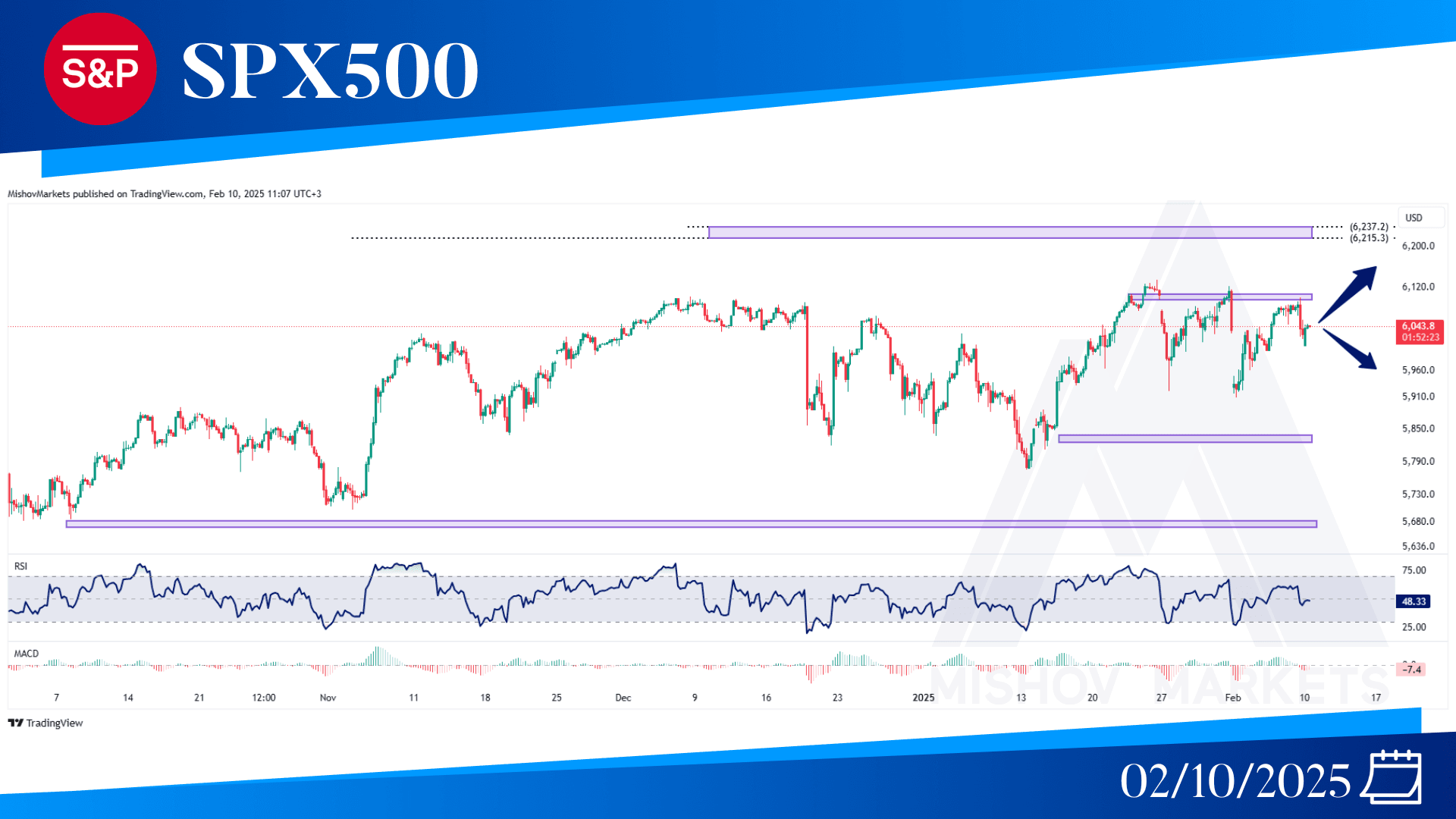

As mentioned in Wednesday's analysis of the S&P500 , we are in a bullish uptrend, but there is a critical zone for the price before reaching the previous ATH, which was 6097 to 6107, which for the second time acted as a strong resistance and pushed the price downward. But now we must wait and see price reaction to Powell's testimony, which can have a high impact on markets. We also have targets for price at 6215 and 6237 if we see a close above this 6107 zone, but if we see prices keep their bearish movements, the price can decrease and reach 5840. and we have a strong level for the full pullback at 5668, which can be critical. If it holds up, the price can go higher, and if we have a strong close below this level, we can see the start of a short-term bearish trend.