Market Analysis 05 Mar 2025

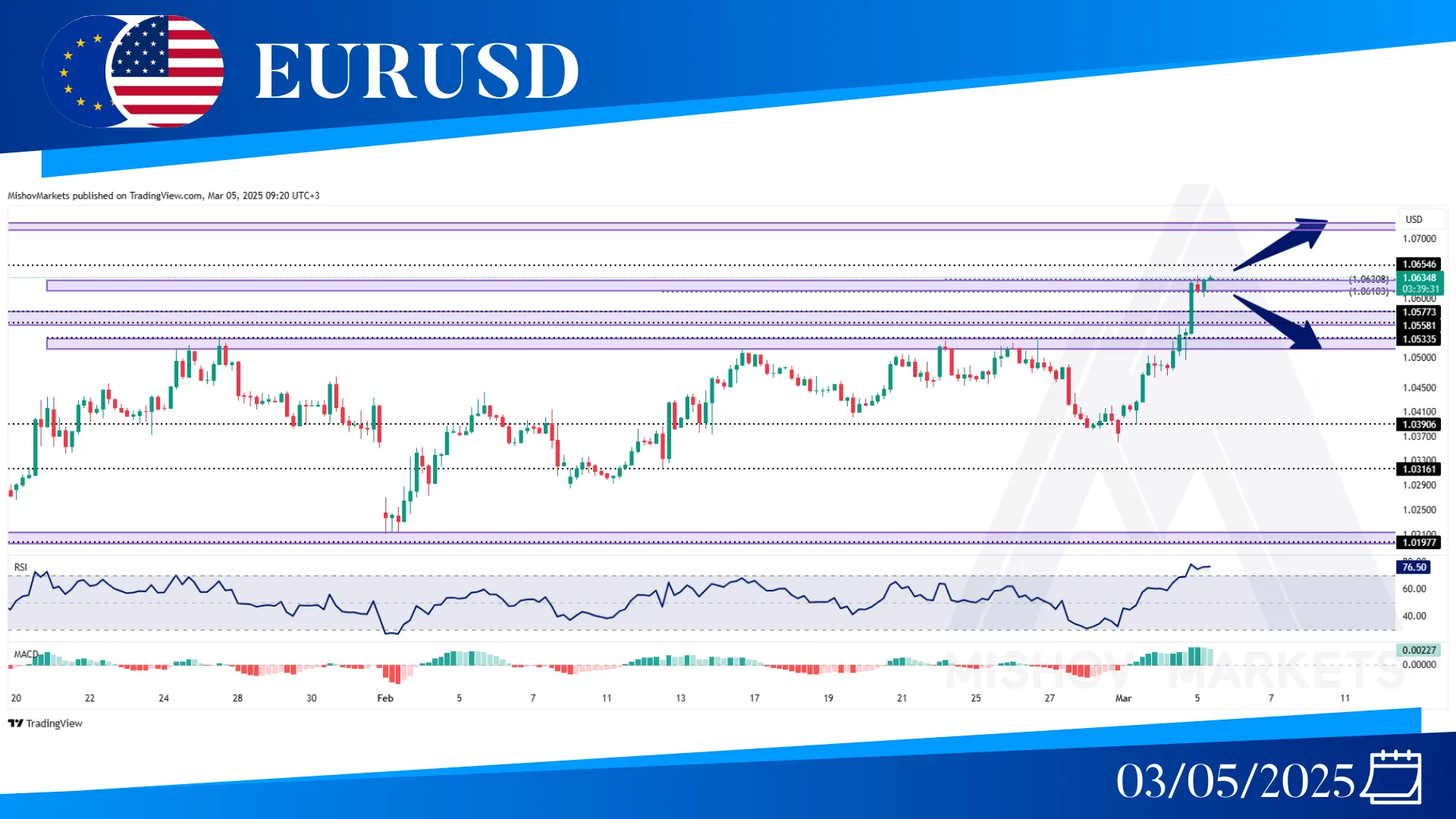

In EURUSD, the price has increased and reached our targets at 1.05770 and is trying to reach our next target at 1.06540, so now we might wait and see price reaction to these zones. We might see a pullback to these zones for retesting the support zone and continuum toward our targets. And if this zone fails to act as a support, the price can start to decrease toward 1.05350, 1.03900, and also 1.01970.

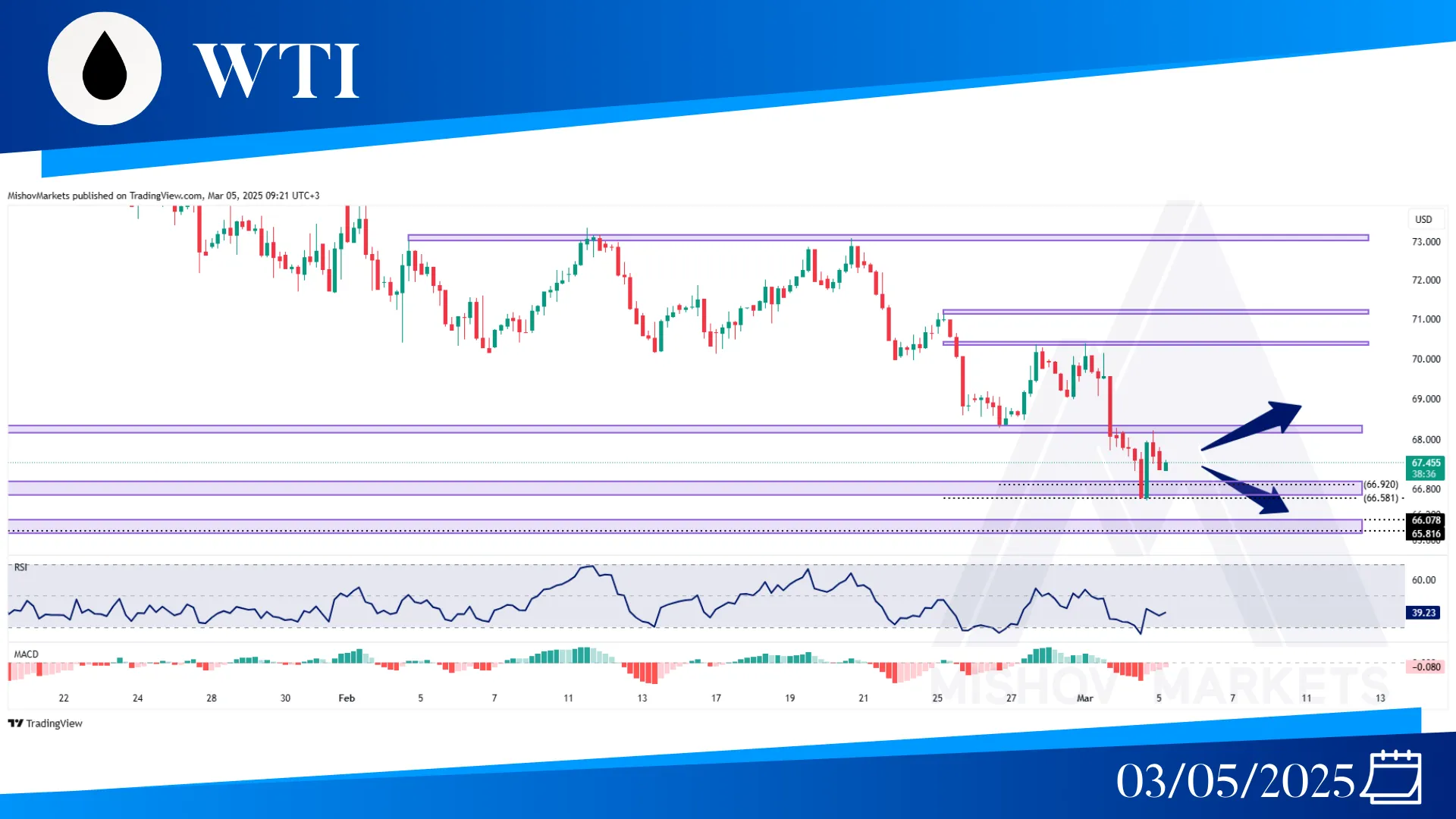

In WTI, the price was not able to continue its bullish movement, and the 70.30 level acted as resistance and pushed the price downward toward our targets at 68.40 and 67.650. Now the price is testing the 68.40 zone for the resistance; if this zone holds, then a movement toward 66.920 and 65.81 is at reach. But if the price continues its upward movement and we see a close above 70.350, then we can confirm that the price has started a bullish trend and might have a target at 73.00.

In XAUUSD, as mentioned in Monday's analysis, the 2874-2879 zone didn’t act as a resistance; the price broke above this zone, and with a pullback to this zone, it started to increase toward our targets.Unless the price remains below the 2942-2938 zone, the market might have hope for bearish retracement, but until we don’t see a strong 4H close below 2829, there is no certainty in bearish momentum to start. Traders should be cautious about the weekly trend, which is still strongly bullish, so have eyes on targets at 2957 and 2974-2990 zones.

In the S&P 500, the price was unable to go above the 6005-6015 zone to create a new higher high and started to decrease from 6000 toward our bearish targets at 5840-5830, and the price is currently below this zone and testing 5830 to see if this zone acts as resistance. If this zone holds, then movement toward 5706-5690 is within reach, but if we saw an upward movement, then we have targets at 5915 and 5996.