Market Analysis 05 Feb 2025

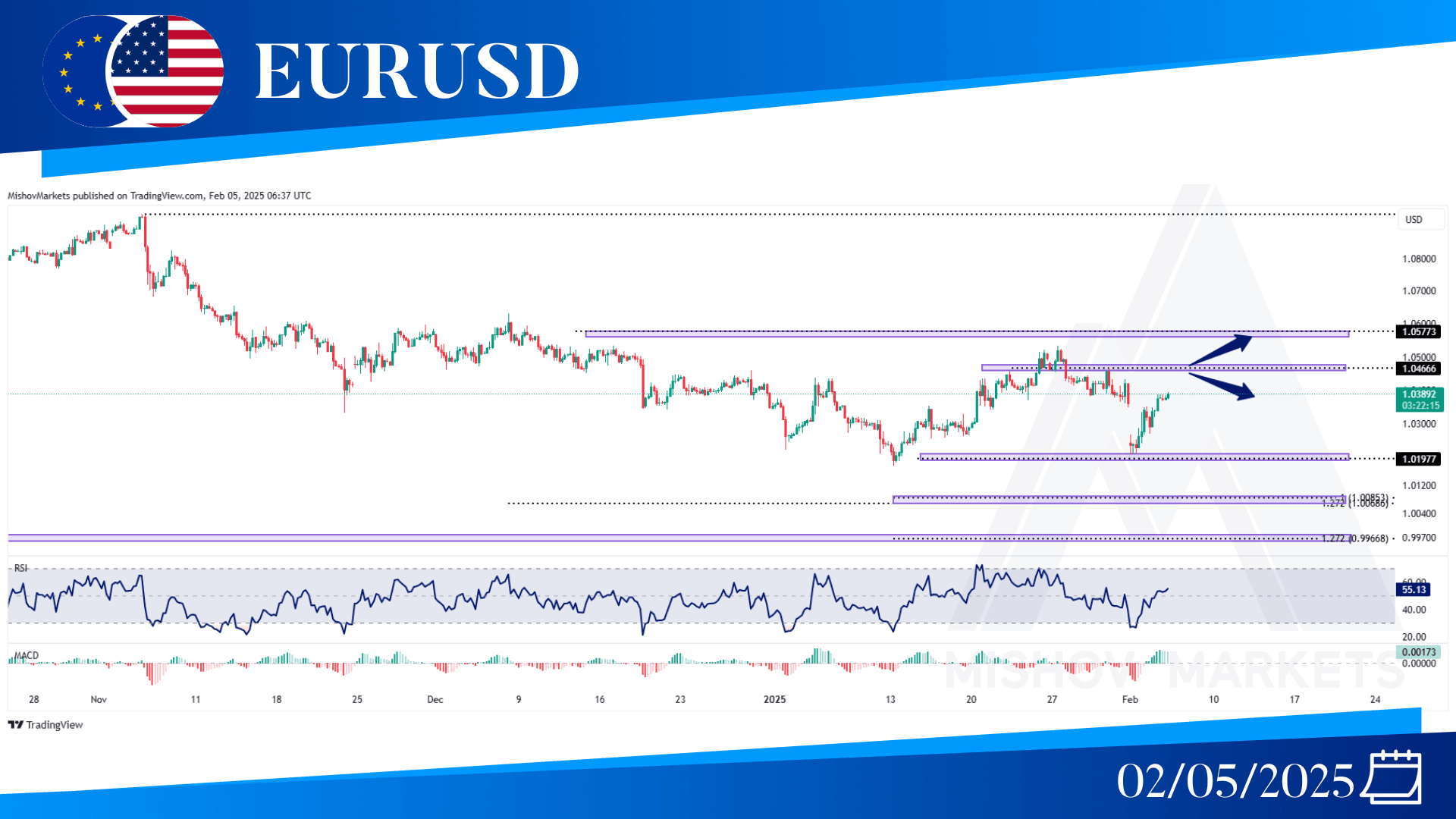

In EURUSD, price has received great support so far from our zone, 1.02154-1.01910, which was necessary for the price. We had a massive price gap that happened during the weekend, and now the price has filled this gap. now We need to be more cautious about the zone that has rejected the price twice, and this time as well it can act as a QM level, but if we saw a break above this zone, then we could have eyes on 1.05585. Also, if the price break our support zone and we see a close below this level 1.01910 then we can have eyes on our targets at 1.00853 and 1.00686.

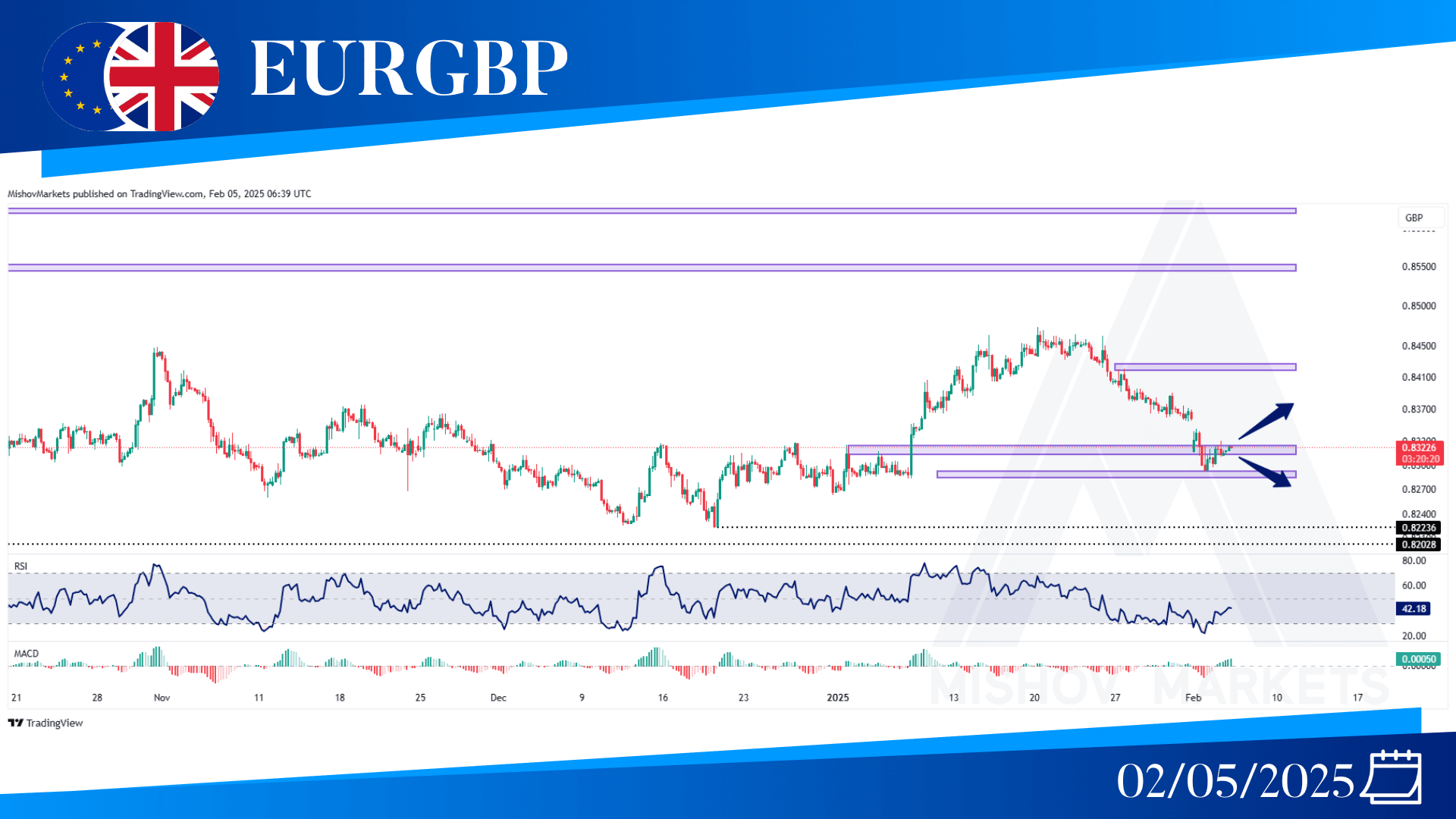

In EURGBP, as expected in the Monday analysis, we saw excellent support from the 0.82914 zone. And currently the price is trying to go and fill the gap we saw on the weekend. if after the filing of the gap, we saw a reversal in price and it closed below of our support zone, then we can wait for our stronger supports like the 0.82236 But we have two price targets if we see strong bullish continuation in price; these are 0.85458 and 0.86220.

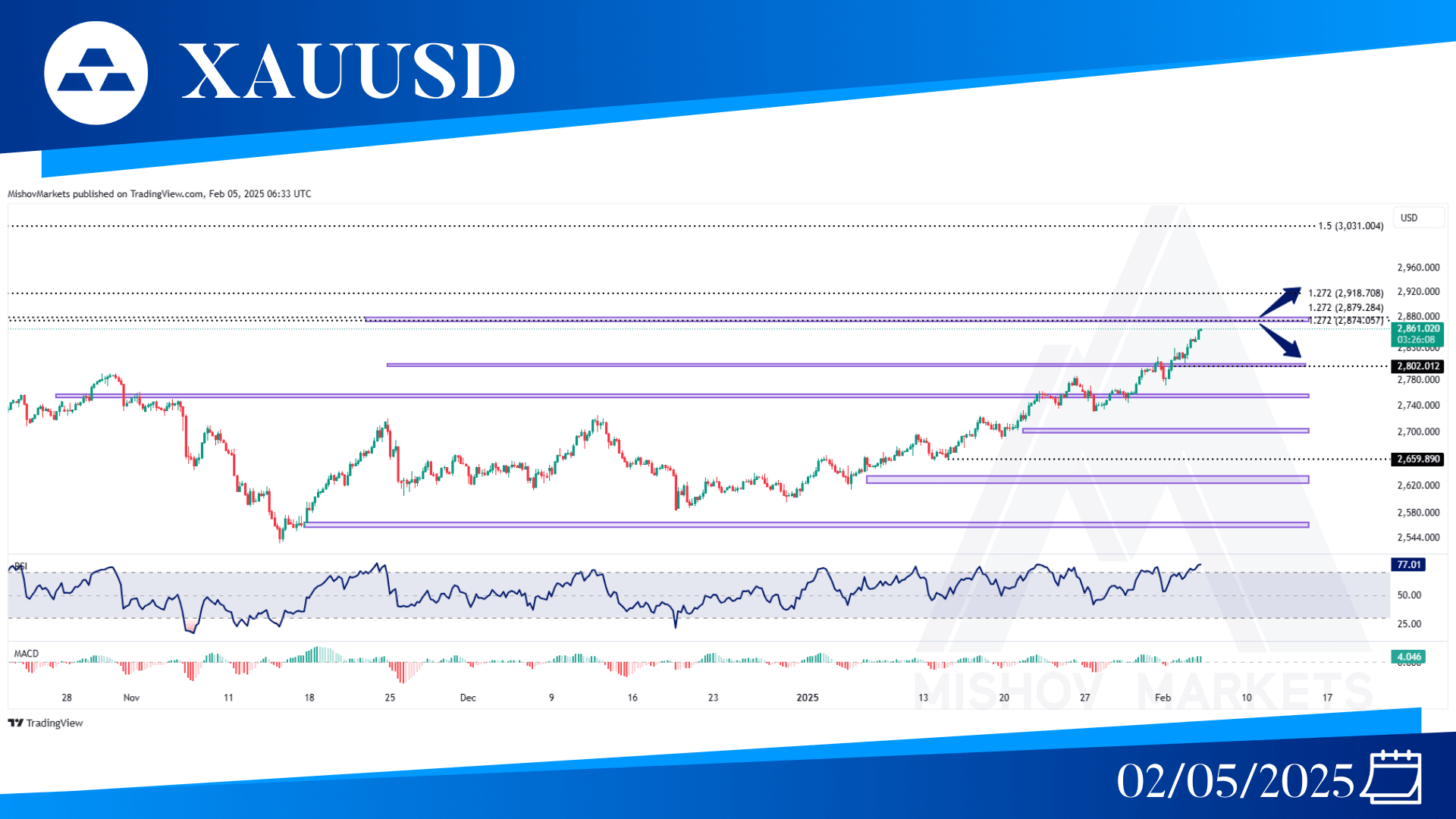

As predicted, XAUUSD has had a strong uptrend move and set a new ATH every day since Monday. As mentioned, we had a support at 2781-2787, which pushed the price higher and toward our targets in 2840.56 to 2845.51. Then, as mentioned, the 2874 and 2884 are within reach, and also 2918 and 3013 are our targets. But if we see a rejection from any of these zones, we also have some targets for bearish movements at 2802 and 2757.But we have two important support levels at 2702.81 and 2645.89, which can attract the price to themselves before aiming for higher prices.

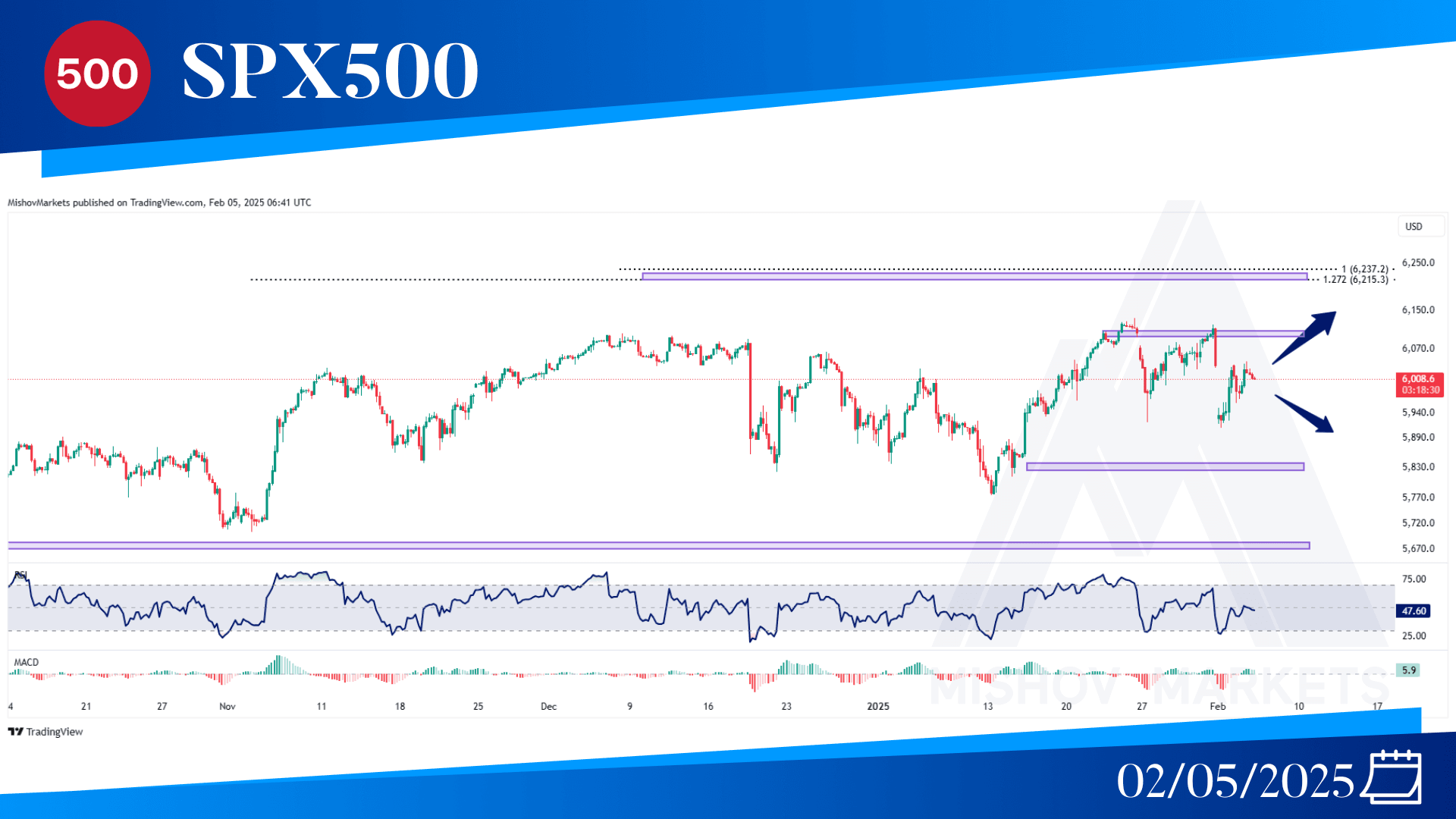

As mentioned in Monday's analysis of the S&P500, we are in a bullish uptrend, but there is a critical zone for the price before reaching the previous ATH, that was 6097 to 6107, which acted as a strong resistance and pushed the price 1980 points downward with a massive gap that shows us there is so much uncertainty in the market. But now we are seeing great comeback from price, which had filled the gap as we expected, so if US government stays calm, we can see a trading range toward Friday and NFP report and then we should see what will happen. We also have targets for price at 6215 and 6237, but if we see prices keep their bearish movements, the price can decrease and reach 5840. and we have a strong level for the full pullback at 5668, which can be critical. If it holds up, the price can go higher, and if we have a strong close below this level, we can see the start of a short-term bearish trend.

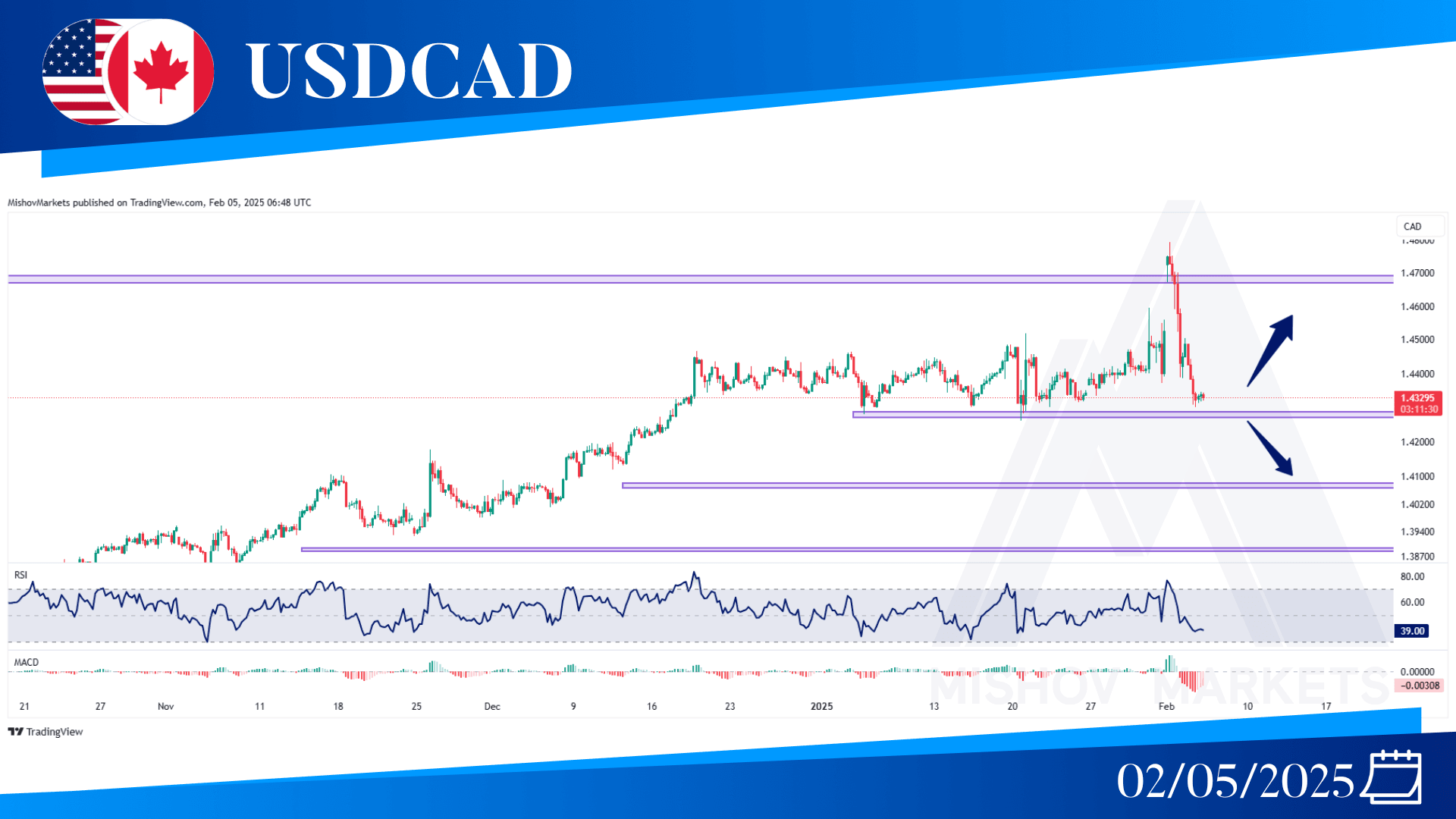

Last but not least, let's get to USDCAD, the currency pair that is going to be the spotlight from now on. After new US tariffs for Canadian imports, we have to pay more attention to this pair as well. After the weekend, we saw the market open with a huge gap and new high for the currency pair since 2016, which the market reacted vigorously to and pushed the price lower. We have a zone, which is quite important for the price to hold, which is 1.42800; if this level breaks, then we can go lower and see targets at 1.40587 and 1.38145, but if it keeps, we can go higher to unseen prices since 2016, such as1.51000 and 1.60000 .