Market Analysis 04 Aug 2025

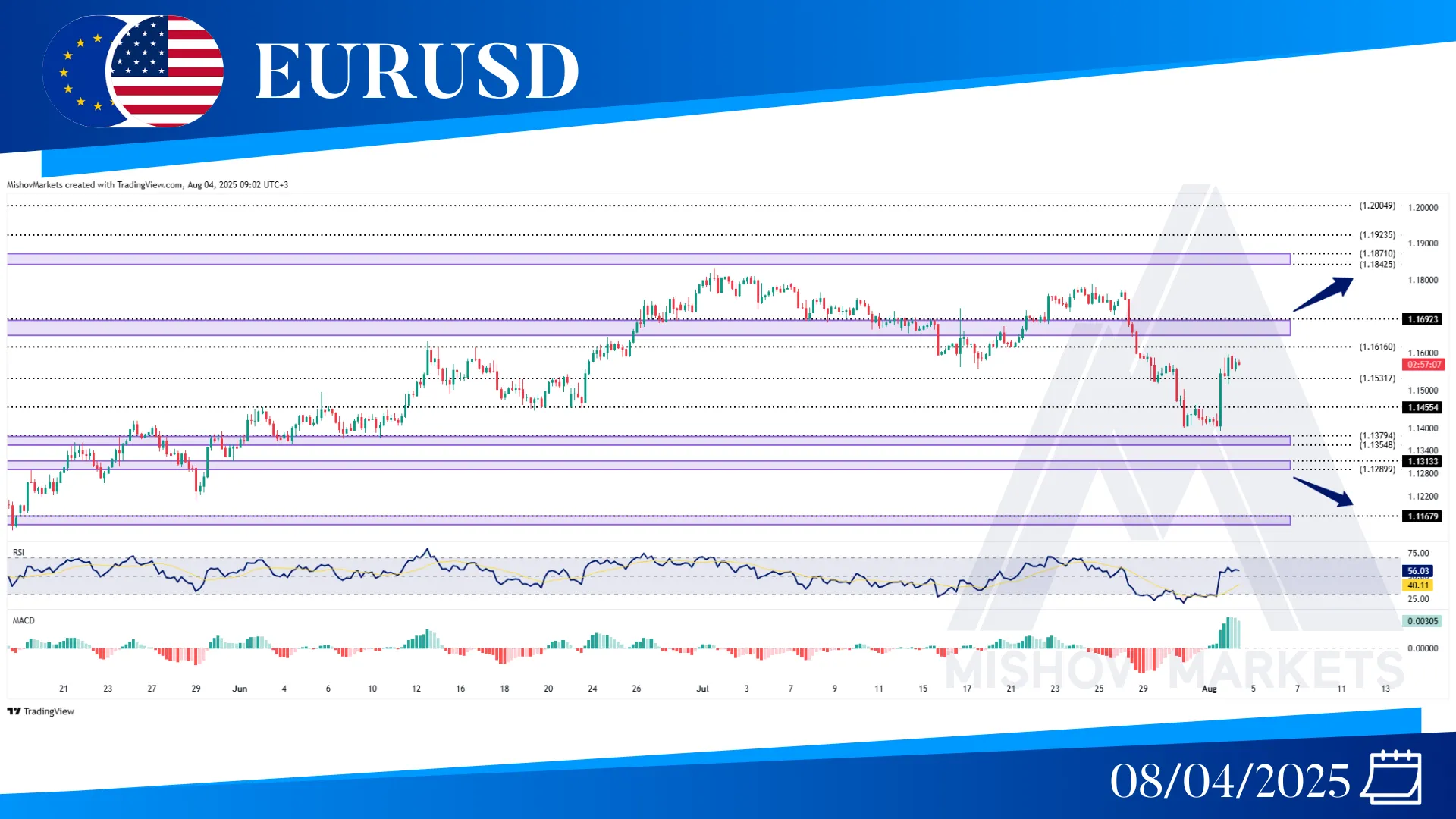

In EURUSD, as mentioned in Wednesday’s analysis, the price provided a close below 1.15310 and decreased further toward our targets at 1.14550 and 1.13540-1.13750 zones. But 1.13950 has supported the price and pushed it higher toward 1.15310 and 1.16530. Now it could continue to reach our bullish targets at 1.16530, 1.17455, 1.18420-1.18710, 1.19230 and 1.20040. In the meantime, the 1.16920-1.16530 zone might act as resistance and push the price toward our targets at 1.15310, 1.14550 and 1.13540-1.13750 zone once more and further toward 1.13130-1.12900 and 1.11680.

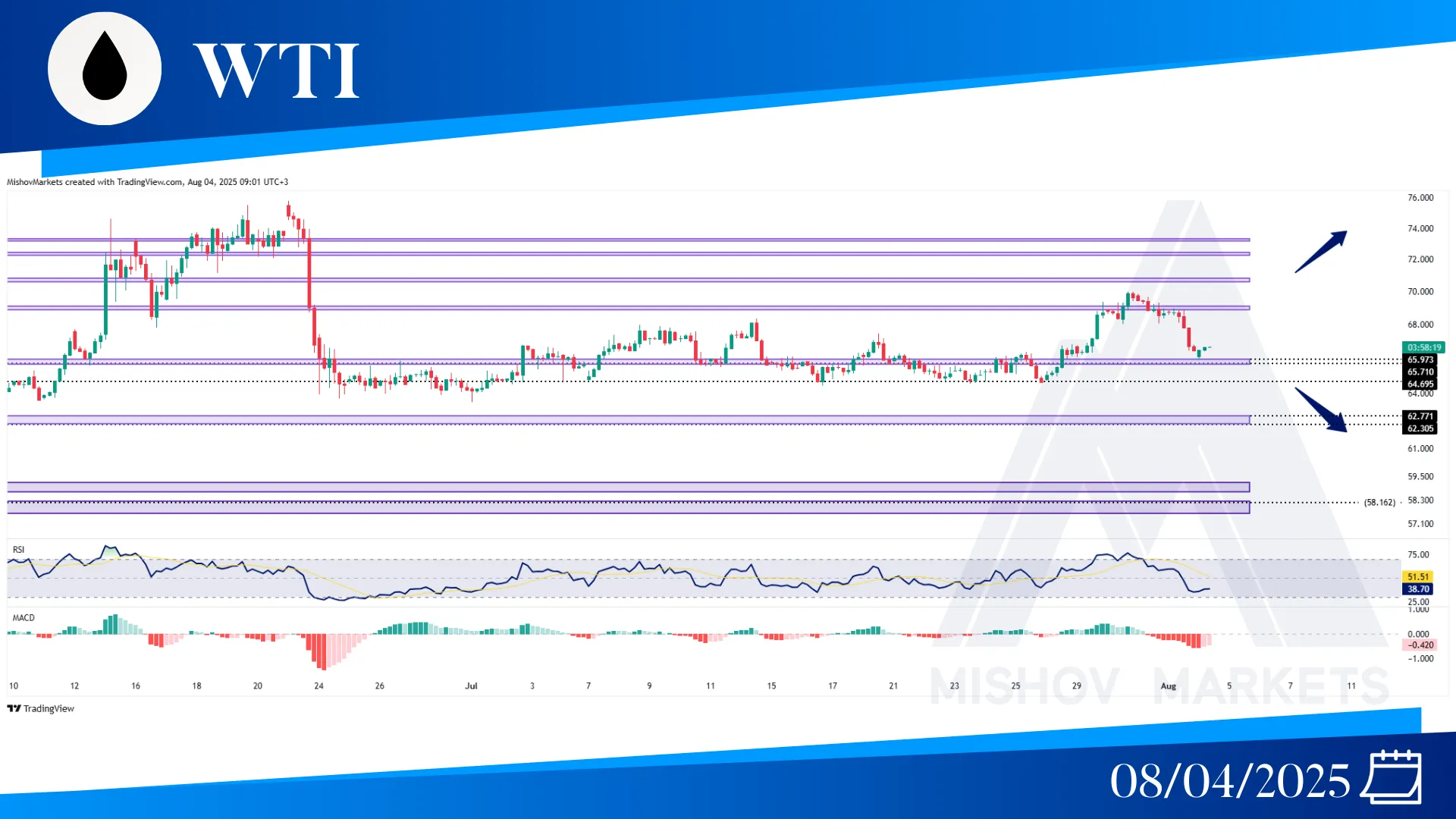

In WTI, as mentioned in Wednesday's analysis, the price faced a resistance from 69.100 and started to move toward 65.970-65.710. Now if this zone acts as support, then it could continue to increase toward 69.100 and if it provides a close above the 70.000, then it could continue to move toward the 70.690 and 72.200. But if 65.970-65.710 fails to support and then also the 64.690 or 63.900 zones fail to support the price and it provides a close below 63.400, it could decrease further toward 62.770-62.300 and 59.200-58.840.

In XAUUSD, as precisely mentioned in Monday’s analysis, the price continued to decrease and reached our target at 3289. Then after the NFP, it started to increase toward our targets at 3358. The price is currently attempting to increase more, but to do so, it must provide a close above 3370. After that, it may increase further toward 3383, 3398-3407, 3429, 3448, 3490-3500, and 3580. But if it faces resistance, then it could return to test the 3314-3305 for support and then start to move toward its bullish targets. But if this zone, or 3289, fails to support, then it could decrease further to 3247, 3213-3224, or 3173-3182.

In the S&P 500, as precisely mentioned in Monday’s analysis, the price was unable to break above 6425 and faced a resistance at the 6418 zone and has started to decrease toward our targets at the 6364-6361, 6335-6326, and 6227-6214 zones. Now if the 6227-6214 acts as support, then the price could increase toward our target at 6300, 6326-6335, 6361-6364, and 6418. But if the 6214-6227 or 6177 zones fail to support the price, then it could decrease further toward our targets at 6132-6119, 6063, and 5975.