Market Analysis 02 Feb 2026

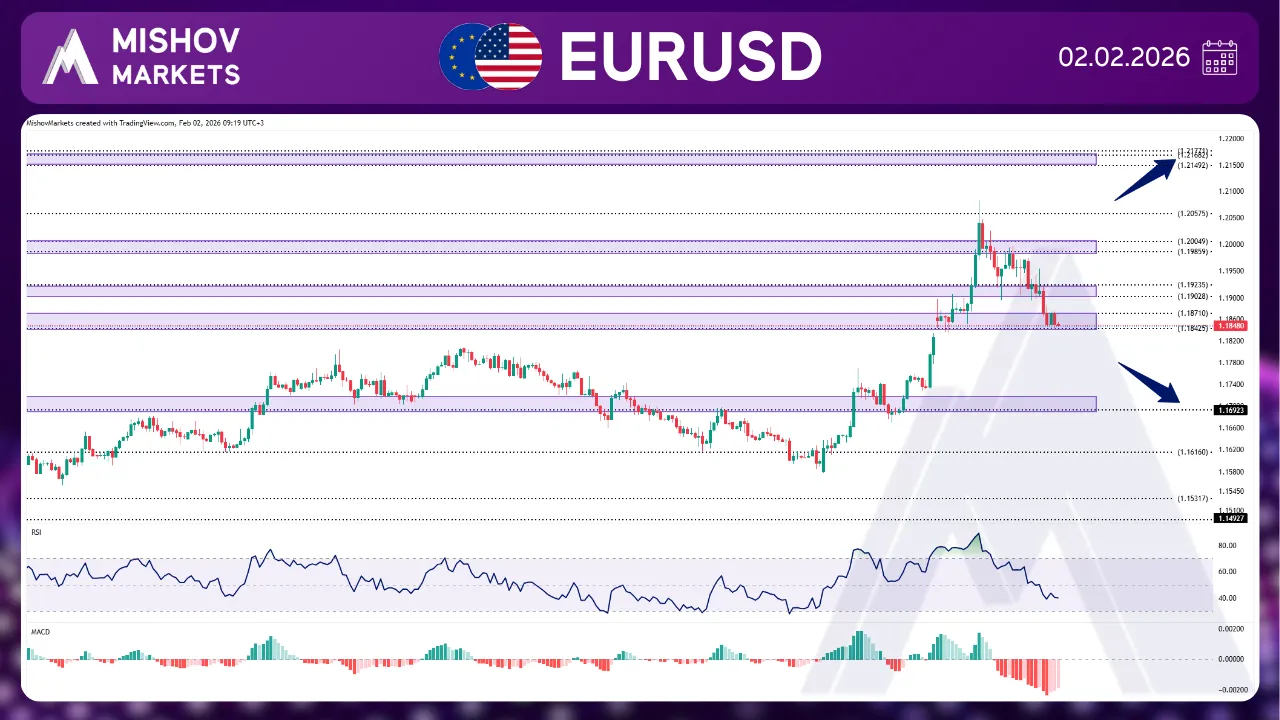

In EURUSD, as precisely mentioned in Wednesday's analysis, the price failed to receive support from 1.19850-1.20040 and started to decrease and reached our targets at 1.19020-1.19230 and 1.18710-1.18400. Now, if the price receives support from 1.18710-1.18400, it may continue to rise and reach our targets at 1.19020-1.19230, 1.19850-1.20040, and 1.20575 once more, and if it provides a close above 1.20850, then it could continue to increase and reach our next targets at 1.21490-1.21770 and 1.23140-1.23350. However, if the price fails to receive support, it could decrease toward 1.18100 and 1.17200 to seek support. Additionally, if the price breaks below these levels and 1.16160 does not provide support, it could move toward the 1.15320 level for support; but if this level also fails to support, then it could decrease further to reach targets at 1.14950, 1.13540–1.13750, and 1.13150–1.12890.

In WTI, as precisely mentioned in Wednesday's analysis, the price continued to increase, and after breaking above 62.800, it reached our next target at the 62.900-63.550, 64.690, and 65.710 levels, and after facing resistance at the 65.710-65.980 zone, it has started to retrace some of its bullish momentum and has reached our target at 64.690, 63.550-62.990, 61.850, and 61.400-60.980. Now if this zone supports the price, it could increase and move toward our targets at 65.710-65.980 zone once more, and also if it provides a close above 66.250, it may continue to move toward the ranges of 67.790-67.980, 69.100, and 70.640-70.860. However, if it fails to receive support or the 62.900-63.550 zone act as resistance, the price could decrease further toward 59.930-59.600 to seek support. Furthermore, if it breaks the 58.700-58.230 zone and provides a close below 57.400, then it could decline towards the levels of 56.570-56.180, 54.630, 52.020, and 49.880.

In XAUUSD, as mentioned in Wednesday’s analysis, price initially continued its bullish movement and advanced toward our targets at the 5342–5362, 5429, 5468, and 5567 zones. After encountering strong resistance in this area, price experienced a sharp sell-off of nearly 21%, triggering a strong bearish move that reached all of our downside targets within nearly a 12,000-pip range, from 5567 down to 4410–4399. At this stage, if price finds support within the 4410–4399 zone, it may retrace part of its bearish momentum and move higher toward our targets at 4574–4566, 4606–4614, 4638–4641, 4665–4675, 4706, 4777–4791, 4845, 4883, and 4924–4933. However, if price fails to hold above the 4410–4399 support zone, further downside pressure could drive XAUUSD lower toward 4363, 4352, 4343–4331, 4303, 4262, 4215–4205, 4149–4143, and ultimately 4101.

In the S&P 500, as precisely mentioned in Wednesday’s analysis, the price continued to increase, and after reaching 7013, it started to decrease and moved toward our targets at 6978, 6946, 6914-6904, 6880, and 6864, but it failed to provide a close below the 6845 zone. Now if the price receives support from the 6867-6830 and continues to increase, it could reach our next targets at the 6904-6914, 6946, 6978, 7019-7031, 7054, and 7118-7141 zones. However, if the price breaks the 6830 zone and provides a close below 6810, then it could reach the 6803-6788, 6785, 6750, 6727-6720, 6698, and 6675-6665 zones to seek support.